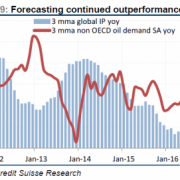

Oil markets will probably balance by the end of next year, with prices rising in the medium term, according to Sultan Al Jaber, the new head of Abu Dhabi National Oil Co.

Prices, which have swung between highs of about $42 a barrel and lows of about $27 this year, will continue to be volatile in the short term, Al Jaber said in an interview with Abu Dhabi dailies The National and Al Ittihad.

Al Jaber, named the company’s chief executive officer last month, expects “to see a slow but upwards improvement in prices in the medium term,” according to a transcript of his comments published in The National. “2016 and 2017 will be the years during which markets will start to rebalance the gap between demand and supply.”

Abu Dhabi, the capital of the United Arab Emirates, holds about 6 percent of the world’s oil reserves. The U.A.E., a member of the Organization of Petroleum Exporting Countries, is among at least a dozen states that have said they’ll meet in Doha, Qatar, on April 17 to discuss a potential freeze in oil output to stabilize prices. European benchmark Brent crude slipped 0.7 percent to $38.41 a barrel as of 9:34 a.m. in London.

Adnoc, as the state company is known, is taking “into consideration prevailing market conditions” as it works toward a target to boost production capacity to 3.5 million barrels a day, Al Jaber said, without specifying the date when that level would be reached. The company is maintaining its current production level and aims to “remain a reliable supplier.”

The U.A.E. pumped about 2.89 million barrels a day last month, according to data compiled by Bloomberg. Abu Dhabi had been seeking to boost capacity to 3.5 million barrels daily by the end of 2017, while company officials have said the target may not beachieved until 2019.

Scroll to top