British wage growth slows as worries grow over oil and Europe

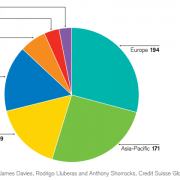

UNEMPLOYMENT in Britain is just 5.1%, the lowest since 2006. Economists expect that when joblessness falls, wages will rise, because employers have to compete more fiercely for staff. After a long slump brought on by the recession, by mid-2015 wages were growing nicely. But as unemployment continued to decline, the economists have been left scratching their heads. In November three-month average growth in pay was just 1.9% year on year (see chart), far below levels in the years leading up to the 2008-09 global crisis.

The shaky world economy is partly to blame. The oil-price slump is biting: wages in the oil-and-gas industry, which are about 50% above the average, have fallen by 12% in the past year. Cheaper oil also prompted a flirtation with price deflation in the middle of 2015, making workers less inclined to push for pay rises. In the year to December 2015 sterling appreciated on a trade-weighted basis by 7% as nervous investors hoarded British assets (it has since been falling back). As exporters’ competitiveness suffered, they tried to cut costs, including pay. The manufacturing sector, which is heavily export-oriented, has seen especially low earnings growth in recent months.

A more pessimistic view is that, even without market turmoil, wages were bound to come down to earth. In the latest figures a strong rise in August fell out of the rolling three-month average. Mark Carney, the governor of the Bank of England, pointed out on January 19th that long-term unemployment is still 50% higher than in 2007 (though it is falling). In addition, Mr Carney noted that Britons have in recent months reduced the number of hours they work, which is also suggestive of weak demand for labour.

Yet talk of labour-market “slack” is hard to reconcile with businesses’ complaints (which are growing, according to surveys by the Bank of England) about finding labour—especially the skilled sort. Firms may be sating their desire for skills without paying full whack, argues Doug Monro of Adzuna, a job-search website. Mr Monro reckons that, instead of hiring people with experience, more businesses are choosing to hire youngsters, whose wages crashed in the crisis, and train them up. Penguin Random House, a publisher, may be an example: it has announced that it will no longer require job applicants to have a degree.

In recent months the workforce has thus become younger, pushing down average wages. However, with youth unemployment now lower than in mid-2008, firms may struggle to continue this practice for much longer. On top of this, flows of people moving from one job to another, which fell sharply during the recession as workers clung on to whatever position they could find, have picked up and are now back at pre-recession levels, says Samuel Tombs of Pantheon Macroeconomics, a consultancy. A year ago there were slightly more vacancies than jobseekers, according to data from Adzuna; now there are twice as many openings. Those workers happy to flit between jobs ought to be able to drive a harder bargain on pay.

Add in the new “national living wage”, which is coming into force in April and is worth £7.20 an hour for workers who are 25 or older, and wage growth may pick up again in the coming months. The biggest threat to workers realising these gains, though, is home-grown. Thanks to worries over the forthcoming referendum on membership of the European Union, business investment is slowing, say economists at Barclays bank. If investment shrinks, productivity will suffer. Britons could then once again face measly pay growth, just as the economy was picking up speed.

Copyright: The Economist