-

“Mexico said to ask banks for options quotes to fix 2018 prices

-

“Mexico annual sovereign hedge is Wall Street largest oil deal

“Mexico has taken the first step in its annual oil hedging program, asking Wall Street banks for price quotes on the put options it buys to lock in prices for the following year, according to people familiar with the matter.”

“Mexico usually buys put options from a small group of investment banks, starting as early as May but sometimes as late as July, in what’s considered Wall Street’s largest — and most secretive — annual oil deal.”

“The country started asking for quotes from banks as recently as late last week, the people said, asking not to be named because the information is confidential. The people didn’t say whether Mexico executed a trade after receiving the quotes. The Ministry of Finance declined to comment.”

“The Mexican oil hedge, which typically covers between 200 million and 300 million barrels, has the potential to roil the market as the banks writing the put options for the country’s ministry of finance hedge themselves in the market by selling oil and refined products futures and swaps.”

“The put options give Mexico the right, but not the obligation, to sell oil at a predetermined price and time. The hedge runs from December to November.”

“Oil options traders and brokers detected trading activity last Thursday and Friday that in the past has been associated with the banks behind the Mexican oil hedge laying down some of their own risk.”

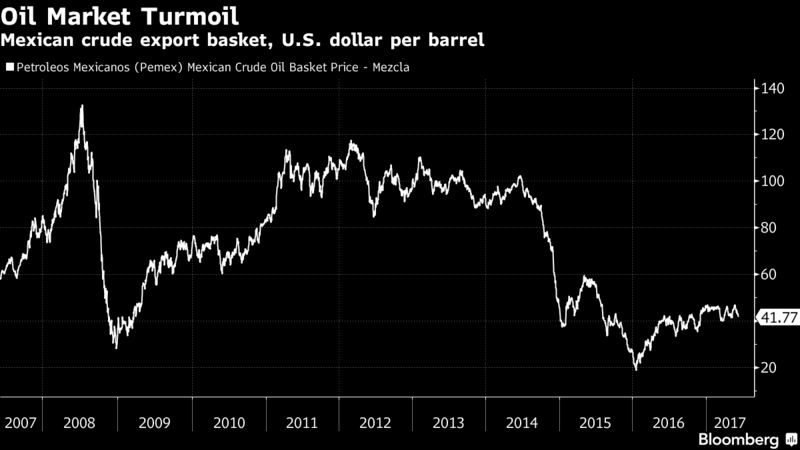

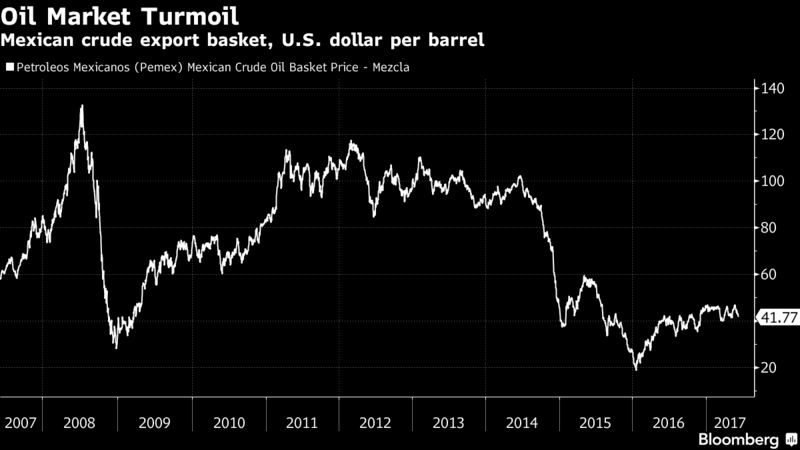

“Last year, the Mexican government spent $1 billion buying put options to lock in an average price for its export basket of $38 a barrel for 2017. Year-to-date, the Mexican export basket has averaged $44 a barrel. In addition, Petroleos Mexicanos, the state-owned oil company better known as Pemex, also hedged some of its production for 2017, spending nearly $134 million buying a put option spread that gives it protection if prices drop below $42 a barrel.”

Handsome Payouts

“The Latin American country has received handsome payouts from its oil hedging program, earning a record $6.4 billion in 2015 after OPEC embarked on a war for market share that sent prices tumbling. Mexico made $5 billion in 2009, after the global financial crisis, and another $2.7 billion in 2016.”

“Since the modern oil hedge program started in 2001, Mexico has made a profit of $2.4 billion — its hedges raked in $14.1 billion in gains and paid out $11.7 billion in fees to banks and brokers. The country also made money in the 1990s, when the hedge wasn’t done on an annual basis.”

“Despite Mexico’s hedging success, few other commodity-rich countries have followed suit. Ecuador hedged oil sales in 1993, but losses triggered a political storm and the nation never tried again. More recently, oil importers Morocco, Jamaica and Uruguay have bought protection against rising energy prices, but their deals had been relatively small.”

“Mexico last year started hedging in late May as oil prices peaked after a soft start to the year. This time, however, oil prices are declining after a relatively strong start to 2017. Brent crude, the global benchmark, peaked at $57.10 a barrel in early January and approached those highs in April. But since then it has weakened to trade below $48 on Friday.”

“Mexico last year started hedging in late May as oil prices peaked after a soft start to the year. This time, however, oil prices are declining after a relatively strong start to 2017. Brent crude, the global benchmark, peaked at $57.10 a barrel in early January and approached those highs in April. But since then it has weakened to trade below $48 on Friday.”

“Mexico has traditionally used banks including JPMorgan Chase & Co., Goldman Sachs Group Inc., Morgan Stanley, Barclays Plc, Citigroup Inc. and BNP Paribas SA for its annual hedge, according to government documents. Last year, the trading unit of Royal Dutch Shell Plc became the first known non-bank to join the hedge, according to people familiar with the matter.”

Scroll to top

“Mexico last year started hedging in late May as oil prices peaked after a soft start to the year. This time, however, oil prices are declining after a relatively strong start to 2017. Brent crude, the global benchmark, peaked at $57.10 a barrel in early January and approached those highs in April. But since then it has weakened to trade below $48 on Friday.”

“Mexico last year started hedging in late May as oil prices peaked after a soft start to the year. This time, however, oil prices are declining after a relatively strong start to 2017. Brent crude, the global benchmark, peaked at $57.10 a barrel in early January and approached those highs in April. But since then it has weakened to trade below $48 on Friday.”