OPEC Deepens Oil Cuts as U.S. Shale Comes Back

Bloomberg / By Brian Wingfield and Samuel Dodge /

“The most globalized effort to cut oil production in history is proving increasingly successful. Now Iraq and Kazakhstan just need to do their bit. OPEC curbed output as promised in May, even though Iraq, the group’s second largest producer, hasn’t complied with the agreement this year. Non-OPEC nations trimming supplies are making steady gains, without help from Kazakhstan. There’s still time to improve: the cuts are set to remain in place through March.”

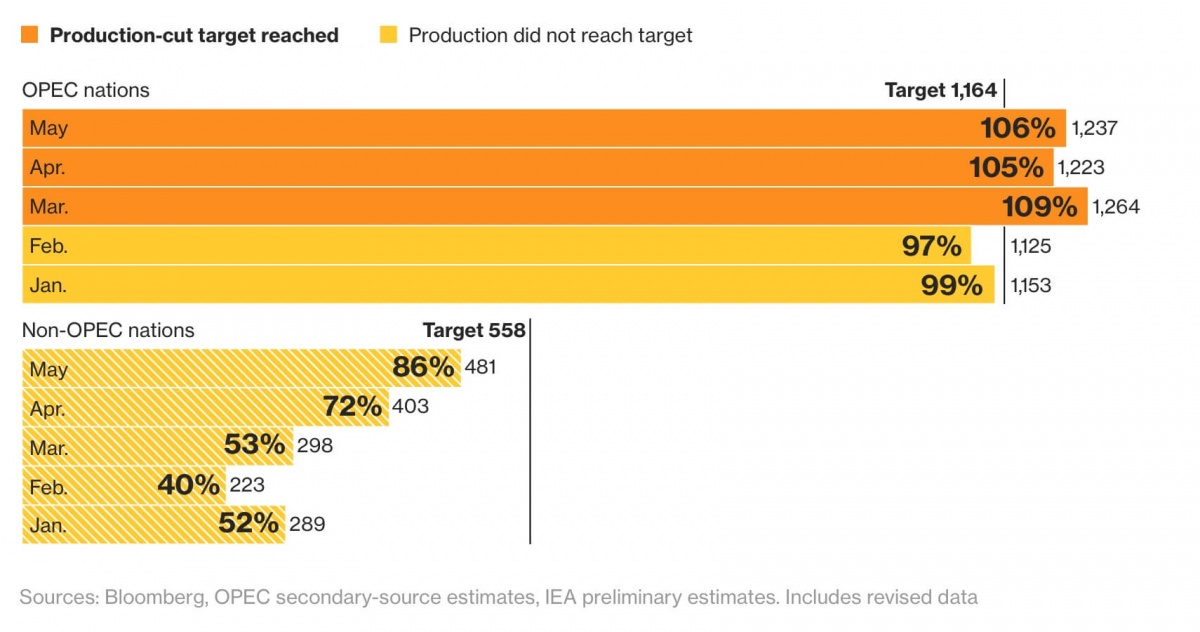

“OPEC Cuts Output More Than Promised”

“Thousands of barrels a day”

“The 21 nations participating in supply cuts are collectively trying to reduce output by almost 1.8 million barrels a day, in most cases using October levels as the starting point. Five OPEC members and three from outside the group met their targets last month, versus nine in April, revised data show. The biggest producers wield the most influence. Russia’s deeper cuts buoyed non-OPEC compliance, even if it didn’t fully meet its own pledged supply curbs.”

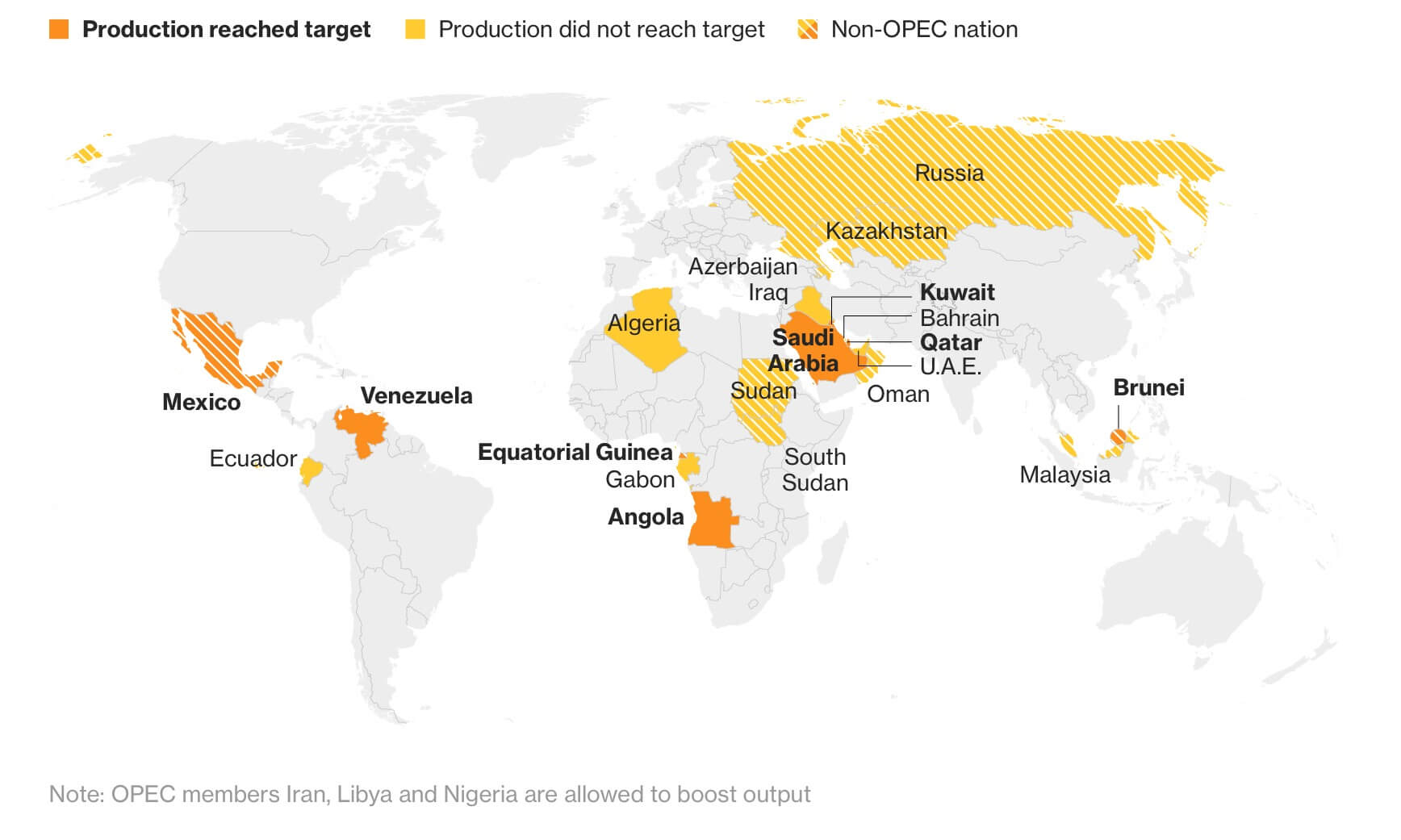

“Which Countries Reached Their Output Target in May?”

“Eight of 21 countries involved reached their target”

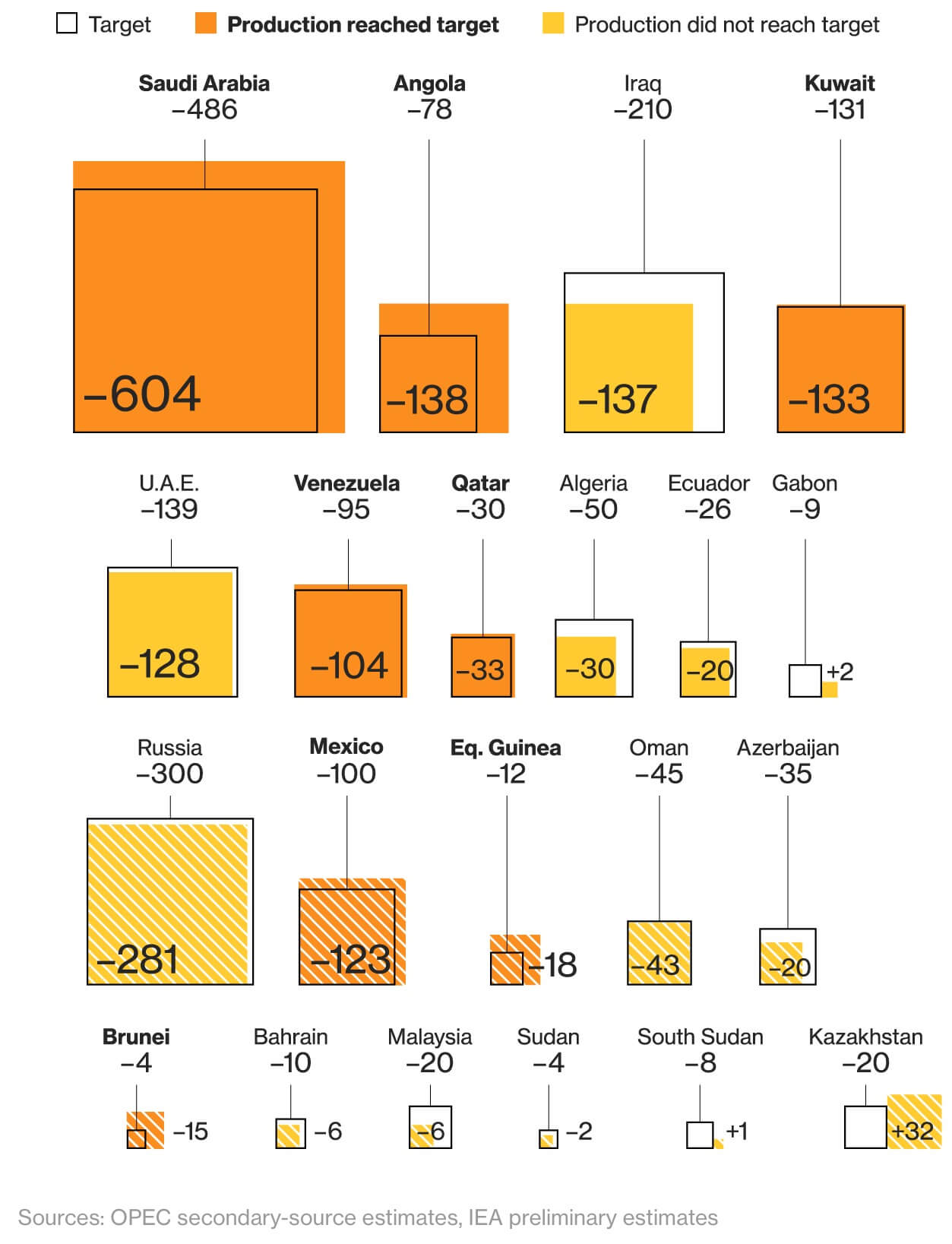

“More than half of the burden for reaching the total supply-cut goal falls upon Saudi Arabia, Russia and Iraq. Only the Saudis have consistently met their target, lifting OPEC’s compliance in the process. Russia, responsible for much of the non-OPEC pledged cuts, has said it would curb output gradually. Iraq’s compliance rate in May fell to 65 percent, versus 87 percent in April, OPEC secondary source data show.”

“May Crude Oil Production”

“Thousands of barrels a day”

“Kazakhstan, which is boosting output from its Kashagan oil field, again produced more crude than it pledged to do under the supply agreement. Small producers Gabon and South Sudan also pumped more than they said they would, according to OPEC and IEA data. Other nations that didn’t cut as much as promised include Algeria and Malaysia. OPEC members Libya and Nigeria are exempt from supply curbs, and Iran is allowed to boost output.”

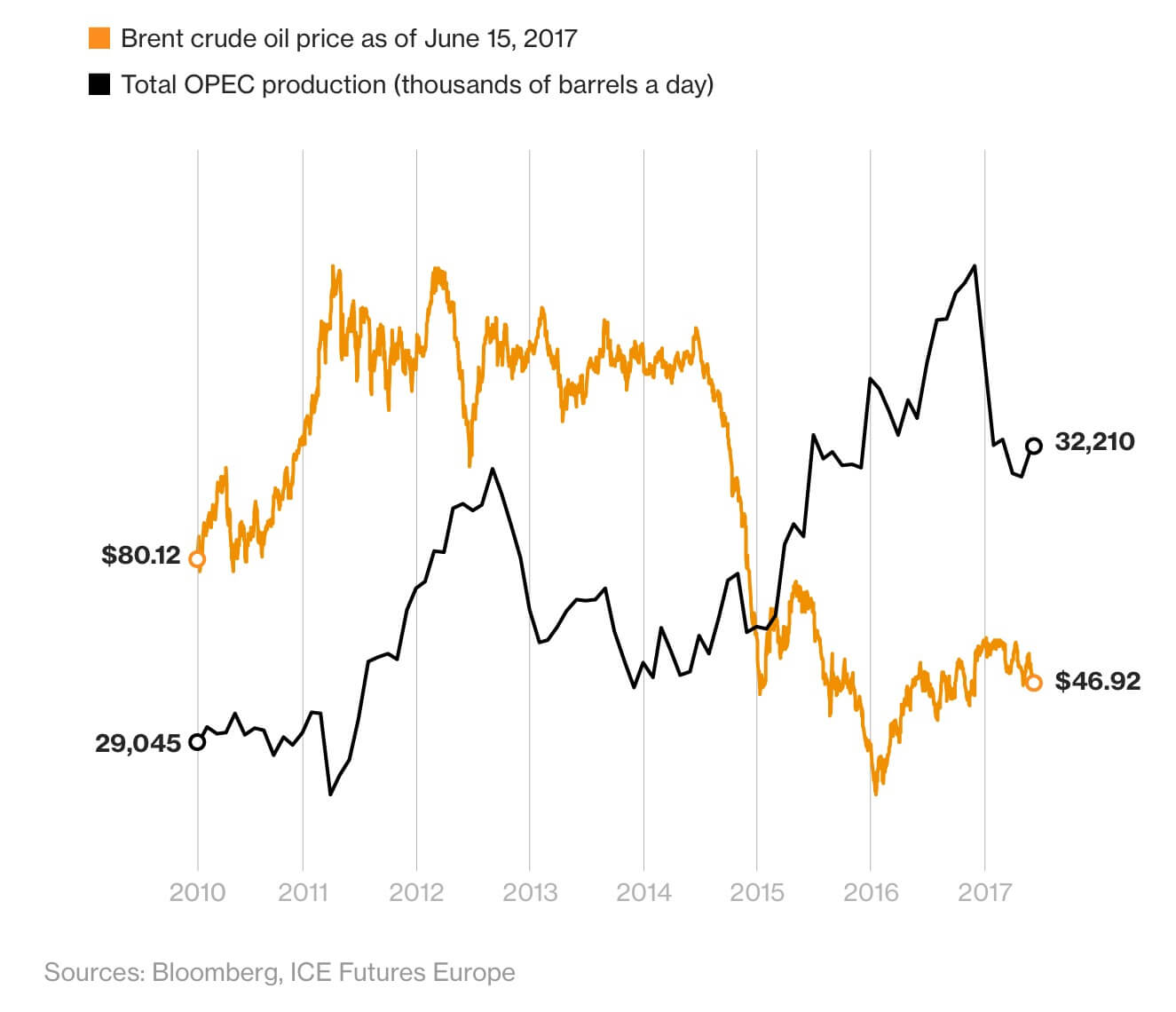

“Price and Production”

“Prices Have Fallen to Near November Levels”