“Union Pacific Corp. sees Mexico trade as a bright spot for its rail freight growth despite tough trade talk from President Donald Trump, said Chief Executive Officer Lance Fritz.Shipments between Mexico and the U.S. have been expanding as much as 6 percent annually over the last six years and now make up about 12 percent of the railroad’s revenue, Fritz said Wednesday in an interview. Union Pacific, the largest publicly traded railroad in North America, has captured 70 percent of the U.S.-Mexico train traffic through its six border crossings, he said.”

““Even while we struggled in volume in ’15 and ’16, we were growing with Mexico,” Fritz, 54, said at Bloomberg’s headquarters in New York. “I think there’s great opportunity there still.””

“U.S.-Mexico trade in goods soared to $524 billion last year from $81 billion in 1993, the year before the North American Free Trade Agreement took effect. Trump has called out U.S. companies for building factories south of the border and often points to the U.S. trade deficit with Mexico, which was $64 billion last year, leading him to assail the trade pact. The administration has signaled it will hold talks with Mexico to renegotiate Nafta.”

“Trump’s anti-trade comments don’t worry Union Pacific, according to Fritz, who said he has spoken with Commerce Secretary Wilbur Ross and others in the administration. Those officials are focused on fairness and bilateral deals and aren’t expected to erect significant trade barriers, Fritz said.”

““They’re quite pragmatic and reasonable,” he said. “They understand how inextricably linked our supply chains are in Nafta and globally. They understand the value that brings to both consumers and industry and the job creation it represents for the U.S., notwithstanding there is some dislocation.””

“Chemical Output”

“A burgeoning U.S. chemical-production boom along the Gulf of Mexico also marks a growth area for Union Pacific as new factories are built to use raw materials from shale drilling. About $30 billion of capital investment is being poured into one Texas county alone, Brazoria, near Houston, he said.”

“Union Pacific is tapping that market by building a packaging plant that will enable the railroad to transport plastic pellets from Dallas to West Coast ports for shipment to Asia. That will help fill 85,000 containers a year that now are shipped back empty to the West Coast.”

“Volume at the Omaha, Nebraska-based railroad is growing this year after dropping in 2015 and 2016, mainly as demand for coal slumped. Shipments of the fossil fuel have stabilized after it went from generating 50 percent of U.S. electricity to about 30 percent today.”

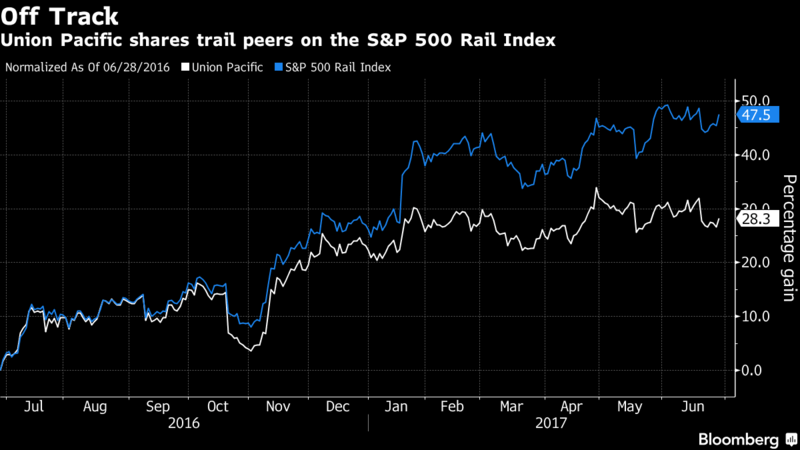

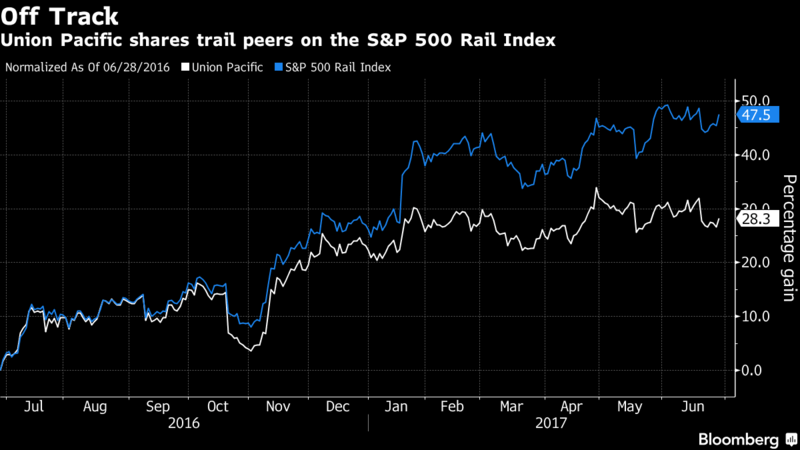

“Still, the railroad has ceded some market share to BNSF Railway Co., which is owned by Warren Buffett’s Berkshire Hathaway Inc. and is Union Pacific’s biggest rival in the western U.S. An excess of truck capacity meanwhile has put pressure on cargo volume and the ability to raise prices, Fritz said. Coal and intermodal — which is freight in containers that can be hauled by ship, truck or train — are especially susceptible to price competition.”

““There just may be some piece of business that our competition is going to secure at a lower price than we’re willing to go,” Fritz said.””

Scroll to top

Fundamental factors to strengthen Pemex12 August, 2019

Fundamental factors to strengthen Pemex12 August, 2019 Offshore Project Development: The Road to First Oil26 July, 2019

Offshore Project Development: The Road to First Oil26 July, 2019