A widely held Western view of China is that its stunning economic success contains the seeds of imminent collapse. This is a kind of anchoring bias, which colors academic and think-tank views of the country, as well as stories in the media. In this analysis, China appears to have an economy unlike others—the normal rules of development haven’t been followed, and behavior is irrational at best, criminal at worst.

There’s no question, of course, that China’s slowdown is both real and important for the global economy. But news events like this year’s stock-market plunge and the yuan’s devaluation versus the dollar reinforce the refrain, among a chorus of China watchers, that the country’s long flirtation with disaster has finally ended, as predicted, in tears. Meanwhile, Chinese officials, worried about political blowback, are said to ignore advice from outside experts on heading off further turmoil and to be paranoid about criticism.

My experience working and living in China for the past three decades suggests that this one-dimensional view is far from reality. Doubts about China’s future regularly ebb and flow. In what follows, I challenge five common assumptions.

1. China has been faking it.

A key tenet of the China-meltdown thesis is that the country has simply not established the basis for a sustainable economy. It is said to lack a competitive, dynamic private-enterprise structure and to have captured most of the value possible from cheap labor and heavy foreign investment already.

Clearly, China lacks some elements of a modern market economy—for example, the legal system falls short of the support for property rights in advanced countries. Nonetheless, as China-economy scholar Nicholas Lardy recently pointed out, the private sector is vibrant and tracing an upward trend line. The share of state – owned enterprises in industrial output continues to drop steadily, from 78% in 1978 to 26% in 2011. Private industry far outstrips the value added in the state sector, and lending to private players is growing rapidly.

In fact, much of China’s development model mirrors that of other industrializing and urbanizing economies in Asia and elsewhere. The high savings rate, initial investments in heavy industries and manufacturing, and efforts to guide and stabilize a rapidly industrializing and urbanizing economy, for example, resemble the policies that Japan, South Korea, and Taiwan followed at a similar stage of their development. This investment-led model can lead to its own problems, as Japan’s experience over the past 20 years indicates. Still, a willingness to intervene pragmatically in the market doesn’t imply backwardness or economic management that’s heedless of its impact on neighboring economies and global partners.

Furthermore, China’s reform initiatives since 2013 are direct responses to the structural changes in the economy. The new policies aim to spur higher-value exports, to target vibrant emerging markets, to open many sectors for private investors, and to promote consumption-led growth rooted in rising middle-class incomes. Today, consumption continues to go up faster than GDP, and investors have recently piled into sectors from water treatment to e-commerce. These reforms are continuing at the same time China is stepping up its anticorruption drive, and the government hasn’t resorted to massive investment spending (as it did in 2008). That shows just how important the reforms are.

2. China’s economy lacks the capacity to innovate.

Think tanks, academics, and journalists alike maintain that China has, at best, a weak capacity to innovate—the lifeblood of a modern economy. They usually argue as well that the educational system stomps out creativity.

My work with multinationals keen on partnering with innovative Chinese companies suggests that there’s no shortage of local players with a strong creative streak. A recent McKinsey Global Institute (MGI) study describes areas where innovation is flourishing here. Process innovations are propelling competitive advantage and growth for many manufacturers. Innovation is at the heart of the success of companies in sectors adapting to fast-changing consumer needs, so digital leaders like Alibaba (e-commerce) and Xiaomi (smartphones) are emerging as top global contenders. Heavy investment in R&D—China ranks number two globally in overall spending—and over a million science and engineering graduates a year are helping to establish important beachheads in science- and engineering-based innovation.

3. China’s environmental degradation is at the point of no return.

To believe this, you need to think that the Chinese are content with a dirty environment and lack the financial muscle to clean things up. O.K., they got things wrong in the first place, but so did most countries moving from an agrarian to an industrial economy.

China is spending heavily on abatement efforts, as well. The nation’s Airborne Pollution Prevention and Control Action Plan, mandating reductions in coal use and emissions, has earmarked an estimaated $277 billion to target regions with the heaviest pollution.That’s just one of several policy efforts to limit coal’s dominance in the economy and to encourage cleaner energy supplies. My interactions with leaders of Chinese cities have shown me that many of them incorporate strict environmental targets into their economic master plans.

4. Unproductive investment and rising debt fuels China’s rapid growth.

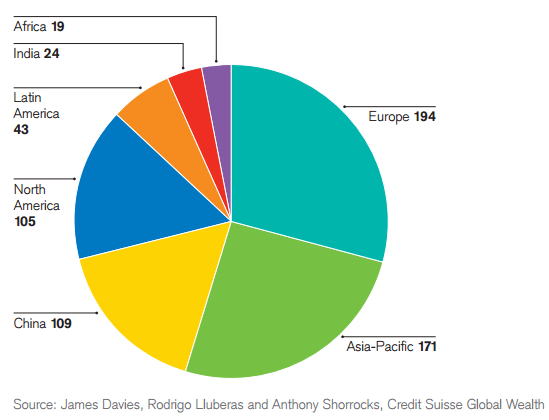

To believe this, you would have to think, as many skeptics do, that the Chinese economy is fundamentally driven by overbuilding—too many roads, bridges, and buildings. In fact, as one economist has noted, this is a misperception created by the fact that the country is just very big. An eye-popping statistic is illustrative: in 2013, China consumed 25 times more cement than the U.S. economy did, on average, from 1985 to 2010. But adjusted for per-capita consumption and global construction patterns, China’s use is pretty much in line with that of South Korea and Taiwan during their economic booms.

China’s rising debt, of course, continues to raise alarms. In fact, rather than deleveraging since the onset of the financial crisis, China has seen its total debt quadruple, to $28.2 trillion last year, a recent MGI study found. Nearly half of the debt is directly or indirectly related to real estate (prices have risen by 60% since 2008). Local governments too have borrowed heavily in their rush to finance major infrastructure projects.

While the borrowing does border on recklessness, China’s government has plenty of financial capacity to weather a crisis. According to MGI research, state debt hovers at only 55% of GDP, substantially lower than it is in much of the West. A recent analysis of China’s financial sector shows that even in the worst case—if credit write-offs reached unprecedented levels—only a fairly narrow segment of Chinese financial institutions would endure severe damage. And while growth would surely slow, in all likelihood the overall economy wouldn’t seize up.

Finally, the stock-market slide is less significant than the recent global hysteria suggests. The government holds 60% of the market cap of Chinese companies. Moreover, the stock market represents only a small portion of their capital funding. And remember, it went up by 150% before coming down by 40.

Rumors drive the volatility on China’s stock exchange, often in anticipation of trading by state entities. The upshot is that the direct impact on the real economy will most likely be some reduction in consumer demand from people who have lost money trading in shares.

5. Social inequities and disenfranchised people threaten stability.

On this one, I agree with the bears, but it’s not just China that must worry about the problem. While economic growth has benefited the vast majority of the population, the gap between the countryside and the cities is increasing as urban wealth accelerates. There’s also a widening breach within urban areas—the rich are growing richer.

Urban inequality and a lack of access to education and healthcare are not problems unique to China. People here and in the West may find fruitful opportunities to exchange ideas because the pattern across Western economies is similar. Leaders of the central government have suggested policies to improve income distribution and to create a fair and sustainable social-security system, though implementation remains a matter for localities and varies greatly among them.

In short, China’s growth is slower, but weighing the evidence I have seen, the sky isn’t falling. Adjustment and reform are the hallmarks of a stable and responsive economy—particularly in volatile times.

Copyright: Forbes

Copyright:

Copyright: