Línea Base Ambiental: Retos y Oportunidades para el Sector Hidrocarburos

Los estudios de Línea Base Ambiental (LBA) son estudios de tipo técnico especializados que son requeridos por la Agencia de Seguridad, Energía y Ambiente(ASEA) de la Secretaria de Medio Ambiente y Recursos Naturales (SEMARNAT) a los regulados del Sector Hidrocarburos para: determinar las condiciones ambientales en las que se encuentran los componentes ambientales de las áreas contractuales, así como la identificación y registro de daños preexistentes y daños ambientales.

La LBA es también un insumo importante para la elaboración de las Manifestaciones de Impacto Ambiental, a efecto de cumplir con lo dispuesto en el contrato celebrado entre la Comisión Nacional de Hidrocarburos (CNH) y los Regulados. Los objetivos principales para la realización de los estudios de LBA son:

- Identificar y describir la infraestructura existente en el área contractual y su estado actual físico y operacional para identificar y evaluar los daños ambientales que hayan sido generados por esta, para el deslinde de responsabilidades.

- Identificar y evaluar las condiciones ambientales en que se encuentran los ecosistemas y recursos naturales, existentes en el área contractual y zona de influencia, previo a la ejecución de las actividades del contrato.

- Evaluar los daños y pasivos ambientales ocasionados por las actividades humanas o procesos naturales en la zona contractual y de influencia a efecto de deslindarse de las responsabilidades

En el artículo 27, párrafo séptimo de la Constitución Política de los Estados Unidos Mexicanos, se establece que las actividades de exploración y extracción del petróleo y demás hidrocarburos se realizarán mediante asignaciones a empresas productivas del Estado o a través de contratos con éstas o con particulares, por lo que la presentación de la LBA ante la ASEA se traduce en una obligación para estas entidades.

Para orientar la elaboración de los estudios de LBA la autoridad a puesto a disposición de los regulados dos guias: a) “Guía para la elaboración y presentación de la Línea Base Ambiental previo al inicio de las actividades de Exploración y Extracción de Hidrocarburos en Áreas Terrestres” y b) la “Guía para la elaboración y presentación de la línea base ambiental previo al inicio de las actividades marinas de exploración y extracción de hidrocarburos en aguas someras”.

Es sumamente importante para los regulados que pretenden el aprovechamiento de zonas contractuales, el identificar, evaluar y detallar de manera precisa los daños ambientales preexistentes a través de los estudios de LBA, ya que solo podrán eximir su responsabilidad ambiental respecto a dichos daños, siempre y cuando hayan sido registrados y manifestados en dichos estudios.

Considernado la relevancia que tienen los estudios de LBA para los regulados, en cuanto al deslinde de los pasivos ambientales y sociales preexistentes de las áreas contractuales, es fundamental que dimensionen la necesidad de que la elaboración de la LBA debe ser realizada por empresas o plataformas técnico-científicas de especialistas calificados y con capacidad demostrada para la realización de este tipo de estudios. El deslindarse de dichos pasivos a través de buenos estudios de LBA y no asumir ningun riesgo financiero, social, legal y ambiental, es uno se los mejores seguros para sostener la viabilidad de sus inversiones y no comprometer su reputación como empresa y regulado ante la eventualidad de que se generen contingencias ambientales.

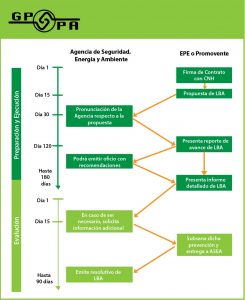

Un buen estudio de LBA debe sustentar además, las bases para el diseño e implementación de los Sistemas de Manejo y Gestión Ambiental y Social (SMGAS) para la prevención, manejo, mitigación y monitoreo de impactos ambientales y sociales durante las fases de preparación, construcción, operación y mantenimiento de los proyectos o de las áreas contractuales que deberán ser establecidos en las manifestaciones de impacto ambiental, estudios del cambio de uso del suelo de terrenos forestales, evaluaciones de impacto social y estudios de riesgo ambiental que correspondan. El proceso de elaboración y evaluación de los estudios de LBA se presenta en la siguiente figura:

Con más de 20 años de experiencia, cobertura internacional y fuerte compromiso con la sustentabilidad, la innovación y la calidad de nuestros servicios en el sector hidrocarburos, energía, turismo, desarrollo urbano, infraestructura, medio ambiente y minería; GPPA y nuestros socios estratégicos NRGI Brokers y Rodríguez Dávalos Abogados, asi como especialistas de diferentes institutos y centros de investigación, hemos conformado una plataforma técnico-cientifica de expertos nacionales e internacionales con la mayor capacidad en el país para ofrecer soluciones integrales y con valor agregado a los regulados del sector hidrocarburos, para resolver sus necesidades en materia de planeación, manejo, gestión ambiental y legal, desarrollo sostenible, fianzas y seguros de responsabilidad ambiental, incluyendo la elaboración de estudios de LBA, Evaluación de Impacto Ambiental, Evaluación de Impacto Social, entre otros productos y servicios.

Para mayor información y cualquier duda o necesidad derivada de la información presentada en el presente boletín, estamos a su disposición a través de:

Consultores en Gestión Política y Planificación Ambiental, S.C.

David Zárate Lomelí

Director General

Teléfono: (998) 6 88 08 75

E-mail: [email protected]

www.gppa.com.mx