Oil prices edged up in Asia on Monday, recovering slightly from last week s decline, but analysts said traders would likely delay any big moves until next month s meeting of key producers.

Hopes for an agreement between Russia, Saudi Arabia and other crude giants to at least freeze output sent both main contracts racing above $40 earlier this month, helped by a dive in the strength of the dollar.

At around 0620 GMT US benchmark West Texas Intermediate was up 50 cents, or 1.27 percent, to $39.96. Brent was up 45 cents, or 1.11 percent, at $40.89.

Members of the Organization of the Petroleum Exporting Countries (OPEC) and key non-members led by Russia are due to discuss a proposed output freeze at a meeting in Doha on April 17.

Bernard Aw at IG Markets told AFP a dip in the number of US oil rigs in operation provided some buying incentives, although business had been slim due to the long Easter break across most world markets.

However, he warned that “the fundamental picture of oil is still a little bit bearish” owing to a global supply glut and a slowdown in the global economy, particularly China.

“Everything hinges on the meeting between OPEC and non-OPEC producers,” Aw said. “If it takes place and they come to some agreement of a production freeze, we could see some gains well beyond $40.”

Qatar s energy minister Mohammed al-Sada, who also serves as OPEC president, earlier said the initiative was backed by 15 countries accounting for 73 percent of worldwide output.

Sanjeev Gupta, who heads the Asia-Pacific oil and gas practice at professional services firm EY, said traders would also be looking at upcoming US and Chinese economic data for direction.

Even as U.S. oil production started to slide in the second half of 2015, the downside risks to oil prices continued to dominate.

In the third quarter, broad-based manufacturing softness and financial market turmoil threatened to derail growth in developed markets, bringing some focus back to the demand side of the ledger. Annual oil demand growth proceeded to drop off in the fourth quarter from above 2 percent to 1.2 percent with acute cracks in China and advanced economies, seemingly confirming analysts’ worst fears.

But Credit Suisse Group AG Global Energy Economist Jan Stuart concludes that oil demand “growth appears to be re-accelerating” in 2016, with the recent bout of softness attributable to a warm winter, subdued activity in resource-extracting industries, and persistent weakness in select sputtering emerging markets like Russia and Brazil.

“Oil demand growth is alive and well,” he writes in a recent note. “We think that with hindsight this winter will look like a dip in an otherwise still unfolding fairly strong growth trend that is partly fueled by the ongoing economic recovery of in North America and Europe and longer standing trends across key emerging market economies.”

While concerns about global growth linger, demand for crude doesn’t match the narrative that a worldwide recession is imminent. In particular, for the world’s two largest economies, the U.S. and China, Stuart notes that oil demand growth has rebounded following a sluggish fourth quarter.

“While on balance oil demand growth appears relatively sluggish still in the first quarter; February data either improved on January (e.g. Brazil, the U.S.); or extended strong growth (e.g. India, South Korea), while in China demand appeared to have rebounded as well,” he writes.

Demand for oil has been increasingly attributable to passenger vehicles rather than its use as an input in the production process, as the middle classes in emerging markets swell.

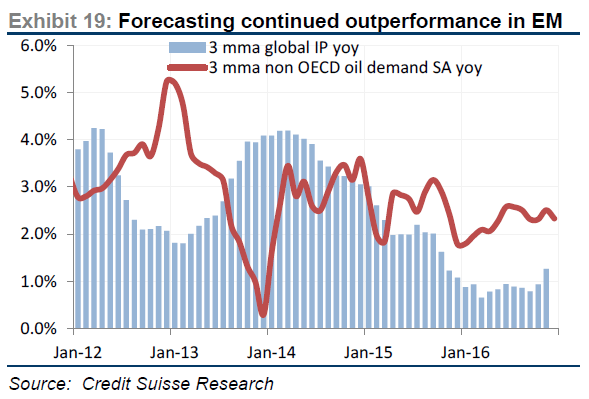

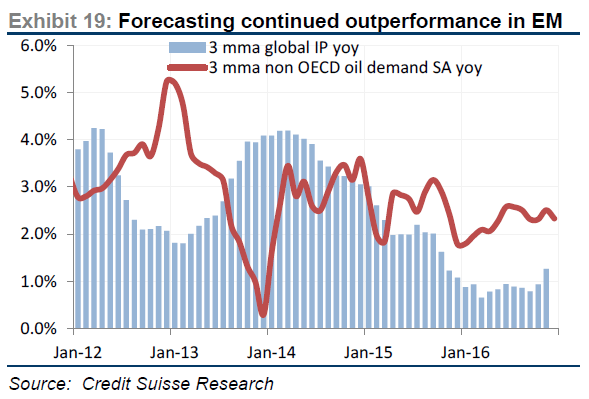

In light of this, Credit Suisse anticipates that crude demand will keep running hotter than industrial production:

“We forecast modestly re-accelerating demand growth over the course of this year, so long as a recession continues to be avoided,” asserts Stuart. “We project in fact that oil demand should continue to outperform historic correlations with industrial production.”

This outlook for demand bolsters the analyst’s confidence that oil prices could hit $50 per barrel in May.

Oil fell around 3 percent on Monday after Iran dashed hopes of a coordinated production freeze any time soon, returning bearish sentiment over a supply glut that has sent prices crashing.

Global benchmark Brent crude futures LCOc1 fell back below $40 a barrel, trading at $39.27 at 1308 GMT, down $1.12 on Friday’s close. Brent hit a 12-year low of $27.10 in January.

U.S. crude CLc1 was down $1.09 at $37.41 a barrel.

“Oil is down because Iran said they would only join the output freeze group once they reached production of 4 million barrels a day,” said Tamas Varga, oil analyst at London brokerage PVM Oil Associates.

He was referring to comments by Iran’s oil minister Bijan Zanganeh on Sunday that the OPEC member would join discussions after its output reached that level.

Iran’s oil exports are due to reach 2 million bpd in the Iranian month that ends on March 19, up from 1.75 million in the previous month, he said.

Zanganeh met Russian counterpart Alexander Novak in Tehran on Monday but talks focused on long-running discussions about an oil and gas swap mechanism.

According to the Shana news agency, Zanganeh said Iran and Russia could cooperate on the swap, which would see Russia send oil and gas to northern Iran in return for Iranian supply to Russian customers in the Gulf.

Saudi Arabia appeared to have stuck to a preliminary deal with some other producers to freeze output, as its crude production held steady in February at 10.22 million barrels per day (bpd), an industry source told Reuters.

OPEC members and non-OPEC producers are likely to meet again in mid-April in Doha to discuss freezing output, OPEC sources told Reuters.

A March 20 meeting in Russia, which was part of an earlier plan, now looks unlikely.

Worries about demand fundamentals moved back into the spotlight as investment bank Morgan Stanley warned that a slowing global economy and high production would prevent any sharp rises in oil prices.

“Oil prices now seem to have bottomed, even though they are likely to stay subdued for the rest of this year before starting to move higher in 2017,” the U.S. bank said in a research note. It added that cheap oil had not provided the boost to growth that many had hoped for.

In a sign that investors are growing more skeptical about a rebound in oil prices, ICE data showed on Monday that speculators had cut net long positions in Brent crude by 9,500 contracts in the week to March 8.

Bjarne Schieldrop, chief commodities analyst at SEB Markets in Oslo, said a roughly 2 million bpd oil surplus would weigh down oil prices in the short term. The imminent restart of a pipeline between Iraq and Turkey and the breakdown in talks about a production freeze would add further downside, he said.

“We are likely to see $35 a barrel before we see $45 a barrel.”

Major oil producers are likely to meet in April to discuss a proposal to freeze output at January levels to stabilize the market, according to four Gulf OPEC delegates.

Ministers from some members of the Organization of Petroleum Exporting Countries had suggested that such a meeting would take place this month in Russia. The talks are now most likely to occur in Qatar’s capital Doha, said three of the delegates, who asked not to be identified because the matter isn’t public.

The probability that Doha will play to host the meeting is high as Qatar is president of the OPEC ministerial conference this year, even as Russia is the country that called for the meeting, two of the delegates said. The meeting may still not take place if there aren’t many important producers attending and agreeing beforehand to freeze production, three delegates said.

Saudi Arabia, Russia, Venezuela and Qatar in February proposed an accord to cap oil output and reduce a worldwide surplus. Crude prices extended gains after their initial meeting on Feb. 16 and have climbed more than 40 percent since slumping to a 12-year low in January. Prices may have passed their lowest point as shrinking supplies outside OPEC and disruptions inside the group erode global oversupply, the International Energy Agency said on March 11.

Russia-Iran Talks

Iran plans to boost crude output to 4 million barrels a day, the highest level since 2008, before it will consider joining other suppliers in seeking ways to re-balance the global oil market. Russian Energy Minister Alexander Novak met Monday with Iranian Oil Minister Bijan Zanganeh in Tehran.

Saudi Oil Minister Ali al-Naimi said last month in Houston that the process of devising a freeze agreement would continue with more discussions in March. Nigerian Petroleum Minister Emmanuel Kachikwu said two weeks later that talks would convene in Russia on March 20. Russia’s Novak told state television channel Rossiya 24 on March 4 that a meeting could take place between March 20 and April 1 in Russia, Doha or Vienna, where OPEC has its headquarters.

So far no countries have received invitations or an agenda for a meeting, the four OPEC delegates said.

The Monte Toledo oil tanker covered the uneventful voyage from Iran to Europe with a haul of 1 million barrels of crude in just 17 days, but its journey has been four years in the making.

On Sunday, the tanker became the first to deliver Iranian crude into Europe since mid-2012, when Brussels imposed an oil embargo in an attempt to force the Middle Eastern nation to negotiate the end of its nuclear program. The ban was lifted in January as part of a broader deal that ended a decade of sanctions.

The 275-meter (900-foot) tanker started offloading its cargo into a refinery owned by Cia. Espanola de Petroleos, near Algeciras, a few miles from Gibraltar. By midday, the vessel had already pumped to shore about a fifth of its cargo.

Jose Ramon Gomez Estancona, the captain of the Monte Toledo, said loading the crude at the Kharg Island terminal off Iran was a similar process to before the embargo. Staff at the port were “happy that normality was returning” to the country’s oil exports, he said.

In southern Spain, the tanker’s arrival was met with little fanfare. It was a quiet Sunday at the refinery, and for the workers, the Monte Toledo is just one of the eight or so vessels they expect to receive this month. By the time the refinery has taken in all the Iranian crude, another tanker from Algeria will already be waiting.

Rouhani Ambitions

Nonetheless, there’s a wider significance. As the Monte Toledo started to pump to shore through two 21-inch floating hoses connected to a giant buoy and a 1.8-kilometer submarine pipeline, Iranian President Hassan Rouhani declared in Tehran that more oil exports “will be added soon.”

Ali Tayebnia, the country’s minister of economy and finance, said Iran’s oil exports will “soon return” to 2 million barrels a day. “Arrangements have been made for the return of Iran to the market,” he said, according to Shana, the Oil Ministry’s news service.

Around Europe, other tankers with Iranian oil are close behind the Monte Toledo. In February, 29 vessels loaded crude from the Middle Eastern nation, according to data compiled by Bloomberg. Of those, three are heading toward Europe — the Eurohope tanker is sailing to Constanta, an oil port in Romania, and the Atlantas is on its way to France. Another one, the Distya Akula, is anchored at the mouth of the Suez Canal, and is likely to head into a Mediterranean port.

Export Recovery

The Monte Toledo and its companions are the vanguard in the return of Iran into the European oil market. Petro-Logistics SA, a Geneva-based tanker-tracking firm, estimated Iran exported about 1.4 million barrels a day in February, up 350,000 barrels a day from the average 2015 level.

Although the increase falls short of the 500,000 barrels a day that Tehran had promised, there are signs that exports into Europe will pick up this month.

“It does take a while to get those fields back up,” said Petro-Logistics director Daniel Gerber. “But I think they’re going to hit the increase of 500,000 barrels a day in March.”

Seth Kleinman, head of energy research at Citigroup Inc. in London, agreed, saying that in addition to higher export volumes this month, more countries were buying.

“You see tankers going to Spain, Romania, Tanzania, France and the U.A.E.,” he said. “You got an uptick to India in February too.”

Still, hurdles remain. Lingering banking restraints mean some customers are finding it hard to transfer payments for Iranian crude and National Iranian Oil Co. has offered to swap crude for gasoline to get deals done, according to local reports.

Iran will want to win back customers in Europe, where Russia, Saudi Arabia, Iraq and other rival suppliers stepped in after the embargo was imposed. Tehran also faces a rival unknown four years ago: the U.S. has started exporting crude and companies such as Exxon Mobil Corp. are shipping American oil into refineries in the Mediterranean.

Before the embargo Europe imported on average about 400,000 barrels of oil a day from Iran, according to the International Energy Agency. Cepsa alone was buying about 60,000 barrels a day. Total SA was among the biggest purchasers and the French company is waiting to receive the Atlantas tanker later this month at its refinery in Le Havre. Other European top buyers in the past, including Repsol SA, Eni SpA and Hellenic Petroleum SA, have yet to purchase any.

If all goes as Tehran has planned, the Middle Eastern country will boost its production back to the 3.6 million barrels a day it pumped in 2011. After the European embargo was imposed and the U.S. tightened other sanctions, Iranian output dropped to about 2.8 million barrels a day. In February, the nation pumped 3 million barrels a day for the first time since July 2012, according to data compiled by Bloomberg.

Brent oil prices hit a high for the year above $40 a barrel on Monday after data showed a smaller-than-expected build in U.S. crude stockpiles, helping U.S. stocks extend recent gains.

Brent was last up $1.87 at $40.59, while U.S. crude rose $1.58 to $37.50.

That lifted shares of energy stocks, which led gains in the S&P 500. The energy index climbed 1.5 percent. Biotechs also rallied, helping to support the broader market.

The Dow Jones industrial average was up 65.23 points, or 0.38 percent, to 17,072, the S&P 500 had gained 3.86 points, or 0.19 percent, to 2,003.85 and the Nasdaq Composite had added 9.78 points, or 0.21 percent, to 4,726.80.

MSCI’s all-country world stock index edged up 0.2 percent. In Europe, the pan-regionalFTSEurofirst 300 index provisionally closed down 0.3 percent.

The euro tumbled against the dollar before Thursday’s ECB meeting at which policymakers are expected to cut interest rates further into negative territory.

The euro was 0.5 percent lower at $1.0950 and down 0.7 percent at 124.34 yen. The U.S. dollar index was down 0.2 percent.

“The U.S. economy is doing relatively well. The dollar will likely hang on to its gains right now,” said Sireen Harajli, currency strategist at Mizuho Corporate Bank in New York.

In the U.S. bond market, U.S. Treasury yields rose in volatile trading as traders increased bets the Federal Reserve will raise interest rates this year in the wake of a strong February jobs report and ahead of a ECB meeting.

Friday’s payrolls data showed 242,000 jobs were created last month and assuaged fears the U.S. economy could be headed into recession. It also revived prospects of further Federal Reserve interest rate hikes this year, something markets had priced out.

The benchmark 10-year note’s yield rose to 1.918 percent, its highest in just over a month. It was last down 9/32 in price to yield 1.9127 percent, up from 1.883 percent late on Friday.

Scroll to top