U.S. economic conditions are “mostly favorable” yet the Federal Reserve remains cautious in raising interest rates because threats loom, New York Fed President William Dudley said on Monday.

Dudley, a permanent voter on rates and a close ally of Fed Chair Janet Yellen, repeated his views in a speech, saying “policy adjustments are likely to be gradual and cautious, as we continue to face significant uncertainties and the headwinds to growth from the financial crisis have not fully abated.”

Addressing a conference at the New York Fed, he repeated he was confident that too-low inflation would rise to a 2 percent goal over the next few years, and that “economic conditions have finally warranted the start of U.S. monetary policy normalization.”

The Fed raised rates modestly from near zero in December, its first policy tightening in nearly a decade. Most economists predict it will move again in June.

New Climate Economy report sets out how Multilateral Development Banks have a crucial role to play in mobilising clean energy investment

The New Climate Economy (NCE) group has this month published a major new report detailing the crucial role development banks need to play in ramping up clean energy investment in developing countries.

The coalition of 20 countries, chaired by former Mexican President Felipe Calderón and Lord Nicholas Stern, has previously said that investments in clean energy are one of the biggest steps that can be taken to close the so-called ’emissions gap’.

By boosting investment to $1tr a year by 2030 yearly greenhouse emissions could be reduced by to 7.5 Gt CO2e, the new report said – an amount bigger than the annual emissions of the United States. Such deep emissions reductions would go a long way towards closing the gap between current projections and the level of emissions cuts needed to stand a reasonable chance of keeping global warming below 2C

However, the new report warns delivering a sharp increase in clean energy investment will require multilateral development banks (MDBs) to play an increasingly active role in supporting the mass deployment of renewable energy in emerging and developing economies.

1.- Development banks are ideal catalysts for clean energy investment

Clean energy had a record year in 2015, attracting $329bn in global investment. However, this is still far short of what is needed both to limit global warming and provide energy access to the 1.1 billion people who still lack it.

MDBs can leverage up to 20 times the amount of money they invest, the report calculates, meaning a big boost in their spending would have a catalytic effect on private sector investment.

2.- MDBs are well positioned to take on risks

While renewables are increasingly competitive in many developing markets with more investment now going into emerging markets than established ones, there are still risks that come with investment in these markets. Exchange rate risks, political risks and construction risk, all of which are higher than in OECD countries, are just some of the ways investors can be deterred from otherwise attractive clean energy projects.

However, since MDBs have a specific remit to promote development in the countries where they work, they are well positioned to take on the risks that other foreign investors may not be willing to shoulder. “They all have a public mandate to enable development globally, and from an energy perspective that is both scaling up energy and making it low carbon at the same time in the next 15 years,” Ilmi Granoff, co-author of the report and senior research associate and the Overseas Development Institute, tells BusinessGreen. “It’s making sure that those risks are addressed for clean energy, and relying on some of the older and new tools to scale up clean energy investments as the core of their energy strategy.”

3.- Co-operation with other players is key

This doesn’t mean that development banks will be taking on all the responsibility alone – a key message from the New Climate Economy is how cooperation between MDBs, governments, and the private sector can allow new projects to be considered that may be too risky for one player to take on alone. Meanwhile, governments will also play an additional important role by scaling up the enabling role they can play in mobilising financing for clean energy, the report notes.

4.-The money is there

A trillion dollars may sound like an awful lot, says Granoff, but there is no global shortage of global capital. Instead, the challenge is to shift incentives to ensure it is unleash in favour of clean energy.

The New Climate Economy group estimates that if low-cost, long-term financing were available for clean energy projects, the cost of clean electricity could be reduced by as much as 20 per cent in developed economies, and 30 per cent in emerging economies.

But in order to unlock this money, the financing system must be re-adjusted to take advantage of the benefits of renewables – their lack of fuel costs, lower operating costs, and flexibility in deployment – while also dealing with the challenges they bring, such as the need for higher grid investment.

“Clean energy is flexible and scalable, it has very low operating costs and often no fuel costs, so it has a bunch of really critical benefits,” says Granoff. “But it also functions differently: the upfront costs are greater, and so the project’s viability is more sensitive to financing costs than fossil fuel power investments. So there’s a bunch of enabling environment issues that have to happen in order to favour that clean energy framework.”

5.- Fossil fuels will have to go

The flip side of the coin, of course, is that while moves are being made to promote and support clean energy, they must also be made to revamp an energy financing structure which until now has heavily benefited fossil fuels.

“It’s not simply about scaling up clean energy investment,” observes Granoff. “If we want the incentives to favour clean energy, we have to incentivising and stop subsidising through public financing high carbon energy systems. We need to be phasing out the financing of carbon energy systems, except in exceptional circumstances where there is an absolutely critical development rational without any viable alternative.

OPEC member Iran and India – one of Asia’s fastest growing source of energy demand – signed a memorandum of understanding (MoU) to develop oil and gas projects, including the Farzad B gas field, Iranian Petroleum Minister Bijan Zangeneh told the Iran-India business conference held at Teheran Chamber of Commerce Saturday, Shana – a media linked to Iran’s Ministry of Petroleum – reported Sunday. “We had thorough conversations today and signed an MoU for development of Farzad B gas field, refinery cooperation, export of crude oil and petroleum products and mutual cooperation in petrochemical industry,” Zangeneh said.

The MoU was signed during a visit to Teheran by Indian Petroleum and Natural Gas Minister Dharmendra Pradhan, who, the Ministry said on its website April 7, hoped to engage “with the Iranian political leadership to work with them, particularly in the hydrocarbon, petrochemicals and fertilizers sectors for mutual benefits, including strengthening of India’s energy security.” According to Zangeneh, Indian investors should consider the development of the Farzad B project as a top priority, adding that “we hope decisions regarding the project’s development will be made before 2017.”

He said the Farzad B gas field can produce 3 billion cubic feet per day (Bcf/d) of natural gas, but Iran has signed an MoU with Indian developers for the production of 1 Bcf/d of natural gas from the field. A consortium comprising three Indian companies, including ONGC Videsh Ltd. and Oil India Ltd., made a gas discovery at the offshore Farzad B field in 2008.

Meanwhile, Zangeneh said both nations have agreed to set up major joint ventures and enhance their strategic relations, adding that “we hope Iranian and Indian companies reach out to each other and, under the new circumstances, the two countries boost their investments.” Indian companies have indicated to Zangeneh their interests to purchase natural gas from Iran to feed their petrochemical and other energy-consuming industries, Shana reported. On its part, Iran could deliver gas to Indian customers in Chabahar or any other ports where the Indians are willing to invest to feed methanol, steel and aluminium plants.

Separately, shareholders of Turkmenistan-Afghanistan-Pakistan-India (TAPI) Pipeline Company Limited signed an agreement in Ashgabat, Turkmenistan Thursday to invest $200 million in the TAPI natural gas pipeline. According to the Asian Development Bank (ADB), the investment includes funds for detailed engineering and route surveys, environmental and social safeguard studies, and procurement and financing activities, to enable a final investment decision, after which construction can begin. Construction is estimated to take up to 3 years.

According to Pakistan’s Minister of State for Petroleum and Natural Resources Jam Kamal Khan, TAPI would supply 487.3 billion cubic feet (Bcf) or 13.8 billion cubic meters (Bcm) of gas from Turkmenistan to meet the South Asian country’s growing energy demand, Indian daily The Economic Times reported Friday. Sean O’ Sullivan, ADB’s Director General of Central and West Asia Department, said the gas pipeline will unlock economic opportunities and diversify the energy market for Turkmenistan and enhance energy security for the region.

Ground breaking of the 1,127 mile (1,814 kilometer) -long TAPI pipeline, a project seeking to ease energy shortages in South Asia, was carried out in December 2015 year in Turkmenistan. The pipeline will be equipped to transport 3.2 billion cubic feet per day (Bcf/d) or 90 million standard cubic meters a day (MMscm/d) gas for 30 years, with India and Pakistan originally expected to receive 1.3 Bscf/d (38 MMscm/d) each, while the remaining 494.4 million standard cubic feet per day (MMscf/d) or 14 MMscm/d was to be supplied to Afghanistan.

So far, Turkmenistan is the only country that has started work to build its section of the TAPI pipeline. The pipeline will travel 480 miles (773 kilometers) through Afghanistan and 514 miles (827 kilometers) in Pakistan before ending at Fazilka in Punjab, India, The Economic Times said.

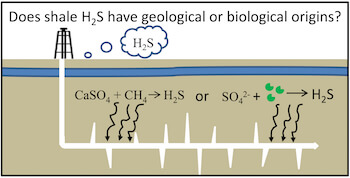

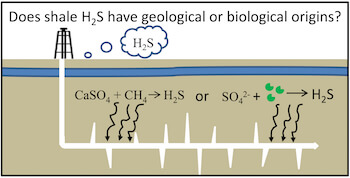

Rice University researchers have developed a technique to model oil and gas formations to determine the cause of souring. Credit: Jason Gaspar/Alvarez Lab

In at least one—and probably many—oil and gas drilling operations, the use of biocides to prevent the souring of hydrocarbons wastes money and creates an unnecessary environmental burden, according to researchers at Rice University.

The Rice lab of environmental engineer Pedro Alvarez reported that soured hydrocarbons found in the Bakken Formation underneath the Northwest United States and Canada are caused by primarily geochemical reactions rather than microbial ones; the researchers questioned the need to pump costly biocides into the well to kill sulfide-producing microbes.

The team’s finding offers a way to cut costs at wellheads where biocides may be unnecessary while keeping them out of the environment, where they may promote the development of biocide-resistant bacteria, Alvarez said.

The research appears in the American Chemical Society journal Environment Science and Technology Letters.

Soured hydrocarbons are those with high concentrations of hydrogen sulfide gas. The hydrogen sulfide gives oil and natural gas the smell of rotten eggs, can be toxic to breathe and is highly corrosive. For this reason, the gas has to be removed from crude oil before it can be transported or refined.

Curtailing the use of biocides when the source of souring is not from microbes would reduce operation costs and mitigate potential impacts to microbial ecosystems, Alvarez said.

The Rice-led team set out to solve a long-standing puzzle over what in an individual formation makes hydrocarbons go sour. Either microbial life or the geochemical environment can catalyze the reaction, but engineers are rarely able to determine which is happening.

Alvarez and his co-authors developed an improved map of temperatures to about 2 miles below the surface in eight representative Bakken Formation fracture wells. They showed that downhole temperatures in the formation are equal to or exceed the upper known temperature limit—252 degrees Fahrenheit—for microorganisms’ survival.

The team also analyzed isotopes of sulfur isolated from hydrogen sulfide taken from the wells. They found all of the isotopes tested suggested geochemical origins. Water samples from the same wells failed to yield DNA concentrations that would indicate the presence of microorganisms.

“The combination of temperature, sulfur isotope and microbial analyses makes scientific, environmental and financial sense,” said Jason Gaspar, a Rice graduate student and lead author of the paper. “Using our method, we could characterize hydrogen sulfide for dozens of wells in a given shale play for less than the cost of adding biocide to one well alone.”

More information: Jason Gaspar et al. Biogenic versus Thermogenic H S Source Determination in Bakken Wells: Considerations for Biocide Application , Environmental Science & Technology Letters (2016). DOI: 10.1021/acs.estlett.6b00075

Oil markets will probably balance by the end of next year, with prices rising in the medium term, according to Sultan Al Jaber, the new head of Abu Dhabi National Oil Co.

Prices, which have swung between highs of about $42 a barrel and lows of about $27 this year, will continue to be volatile in the short term, Al Jaber said in an interview with Abu Dhabi dailies The National and Al Ittihad.

Al Jaber, named the company’s chief executive officer last month, expects “to see a slow but upwards improvement in prices in the medium term,” according to a transcript of his comments published in The National. “2016 and 2017 will be the years during which markets will start to rebalance the gap between demand and supply.”

Abu Dhabi, the capital of the United Arab Emirates, holds about 6 percent of the world’s oil reserves. The U.A.E., a member of the Organization of Petroleum Exporting Countries, is among at least a dozen states that have said they’ll meet in Doha, Qatar, on April 17 to discuss a potential freeze in oil output to stabilize prices. European benchmark Brent crude slipped 0.7 percent to $38.41 a barrel as of 9:34 a.m. in London.

Adnoc, as the state company is known, is taking “into consideration prevailing market conditions” as it works toward a target to boost production capacity to 3.5 million barrels a day, Al Jaber said, without specifying the date when that level would be reached. The company is maintaining its current production level and aims to “remain a reliable supplier.”

The U.A.E. pumped about 2.89 million barrels a day last month, according to data compiled by Bloomberg. Abu Dhabi had been seeking to boost capacity to 3.5 million barrels daily by the end of 2017, while company officials have said the target may not beachieved until 2019.

Scroll to top