“International Frontier Resources Corporation (“IFR” or the “Company”) (TSX-V:IFR) (OTCQB:IFRTF) today announced that its jointly owned Mexican company Tonalli Energia (“Tonalli”) has been named by Mexico’s energy regulator, the National Hydrocarbons Commission (CNH), as one of 12 companies and seven consortiums to qualify to bid on up to 14 blocks in bid round 2.3 scheduled for July 12, 2017. Other qualifying bidders are from Mexico, Canada, the United States, China, Colombia and Uruguay.”

“As previously announced on January 19, 2017, Tonalli has been analyzing and assessing block data, and completed documentation in anticipation of entering the bidding process this July. Concessions are to be awarded under a license contract model for exploration and production that will last 30 years and can be extended for a maximum of two additional terms of five years each.”

“Round 2.3 includes 14 onshore blocks averaging 185 square kilometres (72 sections) available nationwide: six in the Southeastern Basin, four in the Burgos Basin, three in the Veracruz Basin and one block in the Tampico-Misantla Basin. Covering a total of 2,595 square kilometres, these development and exploration blocks contain 25 oil and gas fields with existing 3D or 2D seismic coverage. The Mexican government estimates that the blocks contain total prospective exploration resources of approximately 251 million barrels of crude equivalent and remaining original extraction volumes of approximately 328 million barrels of crude oil equivalent.”

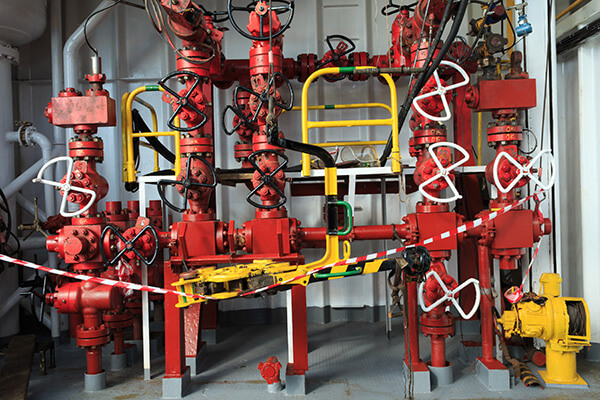

“IFR was one of the first foreign companies to participate in the historic reform of Mexico’s oil and gas sector. Last year, Tonalli assumed operatorship of the Tecolutla block from state-owned PEMEX. Tecolutla was acquired through a 50-50 joint venture with Mexican petrochemical leader Grupo IDESA in last year’s onshore block auction.”

“ABOUT INTERNATIONAL FRONTIER RESOURCES”

“International Frontier Resources Corporation (IFR) is a Canadian publicly traded company with a demonstrated track record of advancing oil and gas projects. Through its Mexican subsidiary, Petro Frontera S.A.P.I de CV (Frontera) and strategic joint ventures, it is advancing the development of petroleum and natural gas assets in Mexico.”

“The Company’s shares are listed on the TSX Venture, trading under the symbol IFR, and on the OTCQB under the symbol IFRTF. For additional information please visit www.internationalfrontier.com.”

““Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility or accuracy of this release”. The Company seeks Safe Harbor.”

The Offshore Frontier

The Offshore Frontier “

“