Wed May 17, 2017 | 1:15pm EDT

REUTERS By David Alire Garcia

“BP Plc’s first foray into Mexico’s recently opened energy market is proving more promising than expected, and the government should offer more big projects to lure investment, the British oil major’s Mexico boss said in an interview.”

“Chris Sladen, country manager for Mexico, said BP expects to increase investment in everything from exploration to retail fuel sales, and looks forward to partnering with state oil company Pemex [PEMX.UL] after losing an early chance for a lucrative tie-up.”

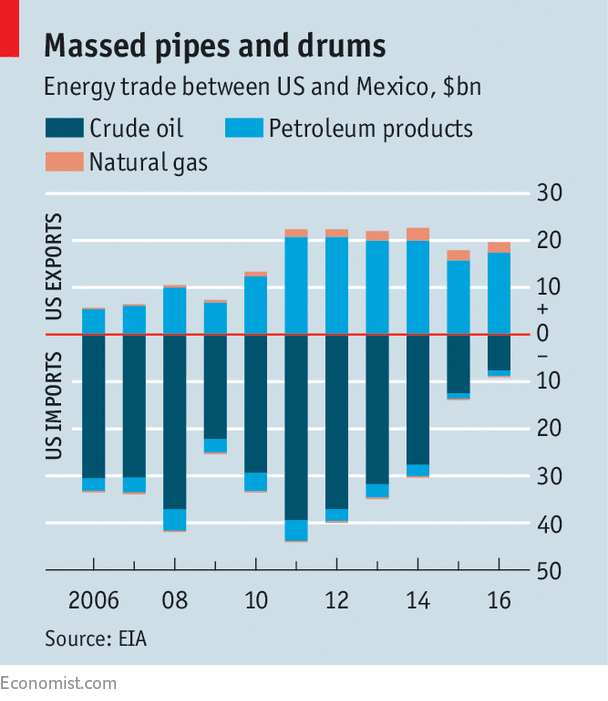

“Mexico wants to attract major investors to reverse years of declining crude output and rising dependence on U.S. natural gas and fuel imports.”

“”To turn that ship around, you need a substantial number of large projects,” Sladen said at BP headquarters in Mexico City on Tuesday. “I would encourage Mexico to offer substantial numbers of large projects because that’s what it takes.””

“BP and others are expanding their presence in Mexico after a 2013 energy overhaul ended Pemex’s decades-long monopoly.”

“”The British firm is already involved in three offshore projects, two in the Gulf of Mexico’s deep waters and another in shallow waters. Sladen said initial company investment in all three could total many hundreds of millions of dollars.”

“”That investment would grow significantly, he added, if the projects are successful.”

“In 2015, Argentina-based Pan American Energy LLC [BPPAE.UL], which is 60 percent BP-owned, won the rights to develop the Hokchi field in the Gulf’s shallow waters.”

“Sladen said three of four committed exploration and appraisal wells have already been drilled there, and early data is promising.”

“”The initial results have suggested that the reservoir volume might be slightly higher than initially modeled. Perhaps it’s 20 percent higher,” he said.”

“During the auction for the Hokchi field, Mexico’s oil regulator estimated that the 15 square mile (40 sq km) area contained 334 million barrels in remaining oil resources.”

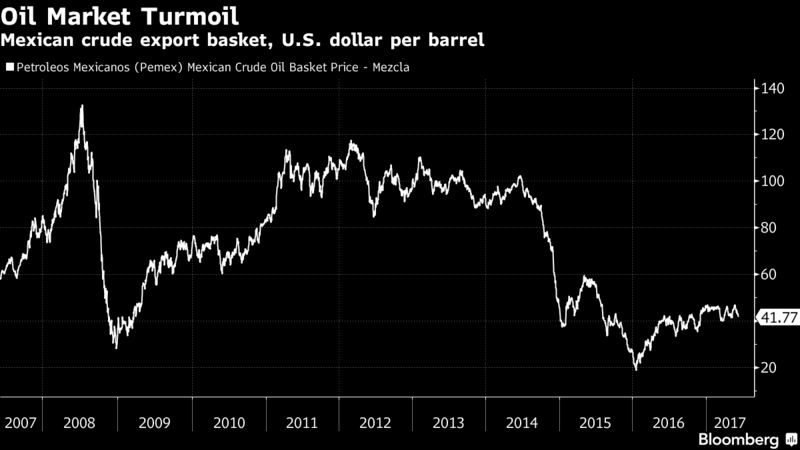

“At current prices for Mexico’s crude exports at around $46 per barrel, a 20 percent larger reservoir volume would mean more than $3 billion in additional value from nearly 67 million additional barrels.”

“Sladen said that data from the Hokchi wells is still being analyzed, and while the drilling program should be completed later this year, investment decisions are still “some months away.””

“Late last year, BP partnered with Norway’s Statoil [STLBR.UL] and France’s Total SA to win development rights for two deep water blocks in the southern Gulf of Mexico’s Salina basin.”

“Exploration plans for each of the blocks will be submitted to regulators by September, Sladen said.”

“While each of the three companies in the consortium has a one-third stake in both blocks, Statoil is the operator, responsible for development.”

“BP has maintained a presence in Latin America’s second-biggest economy dating back to the 1960s, and Sladen has been country manager since 2007.”

“The company narrowly lost out in December to Australian mining and oil giant BHP Billiton in its bid to partner with Pemex on its Trion deep water project, but Sladen still expects to tie up with Mexico’s former oil monopoly.”

“”I see a future of us co-investing with Pemex on major projects,” he said, without going into further detail.”

“BP is still evaluating a range of projects at oil auctions scheduled for later this year, as well as possible investments in ports or storage facilities needed to import fuel, he added.”

“The company has created hundreds of local jobs with hundreds more likely in the near future as it cements its status as Mexico’s first-ever integrated international oil firm, he said.”

“Beyond the three offshore projects, BP has recently won so-called open season rights to surplus capacity on some natural gas pipelines owned by Pemex, Sladen noted.”

“The company also launched Mexico’s first foreign-branded gas station, with plans to open some 1,500 stations over five years. Sladen said that by the end of this year BP could open 200 gas stations.”

“The first station, which opened in March just outside Mexico City, has already become one of the country’s top three retail sellers by volume, he added.”

“There are about 11,400 gas stations in Mexico.””

Wed May 17, 2017 | 1:15pm EDT

“Mexico last year started hedging in late May as oil prices peaked after a soft start to the year. This time, however, oil prices are declining after a relatively strong start to 2017. Brent crude, the global benchmark, peaked at $57.10 a barrel in early January and approached those highs in April. But since then it has weakened to trade below $48 on Friday.”

“Mexico last year started hedging in late May as oil prices peaked after a soft start to the year. This time, however, oil prices are declining after a relatively strong start to 2017. Brent crude, the global benchmark, peaked at $57.10 a barrel in early January and approached those highs in April. But since then it has weakened to trade below $48 on Friday.”