Iran’s crude oil and condensate revenues are expected to reach US$41 billion in the country’s current fiscal year ending on 20 March 2017, Oil Minister Bijan Zanganeh said on Monday.

Zanganeh described the current oil market conditions as ‘satisfactory’, Iranian media reported. For the first nine months of the current Iranian fiscal year, oil revenues reached US$24.7 billion, the minister noted.

Since Western sanctions against Iran were lifted a year ago, Tehran has been quickly ramping up crude oil production, aiming to reach pre-sanction levels. The right to reach pre-sanction levels was the Islamic Republic’s main bargaining chip while pleading for an exemption from the OPEC producers’ supply-cut deal.

Iran was given a leeway not to cut, while Saudi Arabia and its main Gulf Arab allies agreed to shoulder most of the production cuts. Iran’s production was set at 3.797 million bpd as per the deal, below Tehran’s ask for being allowed to reach 4 million bpd, but above Saudi Arabia’s insistence on Iran capping at 3.7 million bpd.

A day after the production deal was sealed, Iran’s oil ministry’s news serviceShana quoted minister Zanganeh as saying that Iran expected to add US$10 billion to its oil income as of this year.

Increased oil production and exports are expected to take Iran out of the recession that it was in in 2015/16 and lead to 6.6 percent growth in real GDP in 2016/17, the International Monetary Fund (IMF) said in an end-of-mission statement last month.

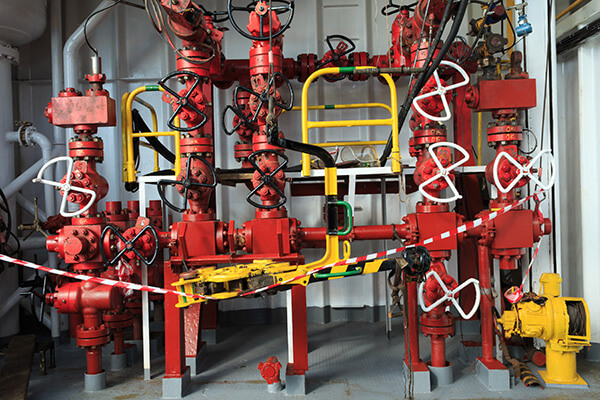

Since the lifting of the sanctions, Iran has been eager not only to increase production to previous levels, but also to lure international oil companies back to developing the country’s vast oil and gas fields.

Earlier this month, the National Iranian Oil Company issued a list of 29 companies that have qualified for bidding in oil and gas tenders of whom only one is a U.S. player: Schlumberger. The biggest European producers including Shell, Eni, Total, and OMV, have all qualified, but BP has pulled out from the race because of worry that relations between Iran and the U.S. will get heated once Donald Trump takes office, according to the Financial Times.