Even as U.S. oil production started to slide in the second half of 2015, the downside risks to oil prices continued to dominate.

In the third quarter, broad-based manufacturing softness and financial market turmoil threatened to derail growth in developed markets, bringing some focus back to the demand side of the ledger. Annual oil demand growth proceeded to drop off in the fourth quarter from above 2 percent to 1.2 percent with acute cracks in China and advanced economies, seemingly confirming analysts’ worst fears.

But Credit Suisse Group AG Global Energy Economist Jan Stuart concludes that oil demand “growth appears to be re-accelerating” in 2016, with the recent bout of softness attributable to a warm winter, subdued activity in resource-extracting industries, and persistent weakness in select sputtering emerging markets like Russia and Brazil.

“Oil demand growth is alive and well,” he writes in a recent note. “We think that with hindsight this winter will look like a dip in an otherwise still unfolding fairly strong growth trend that is partly fueled by the ongoing economic recovery of in North America and Europe and longer standing trends across key emerging market economies.”

While concerns about global growth linger, demand for crude doesn’t match the narrative that a worldwide recession is imminent. In particular, for the world’s two largest economies, the U.S. and China, Stuart notes that oil demand growth has rebounded following a sluggish fourth quarter.

“While on balance oil demand growth appears relatively sluggish still in the first quarter; February data either improved on January (e.g. Brazil, the U.S.); or extended strong growth (e.g. India, South Korea), while in China demand appeared to have rebounded as well,” he writes.

Demand for oil has been increasingly attributable to passenger vehicles rather than its use as an input in the production process, as the middle classes in emerging markets swell.

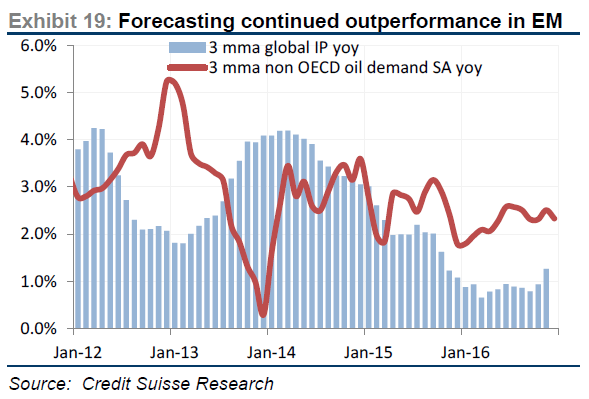

In light of this, Credit Suisse anticipates that crude demand will keep running hotter than industrial production:

“We forecast modestly re-accelerating demand growth over the course of this year, so long as a recession continues to be avoided,” asserts Stuart. “We project in fact that oil demand should continue to outperform historic correlations with industrial production.”

This outlook for demand bolsters the analyst’s confidence that oil prices could hit $50 per barrel in May.

Scroll to top

Breaking Barriers and Building the Future18 March, 2025

Breaking Barriers and Building the Future18 March, 2025 Fundamental factors to strengthen Pemex12 August, 2019

Fundamental factors to strengthen Pemex12 August, 2019 Offshore Project Development: The Road to First Oil26 July, 2019

Offshore Project Development: The Road to First Oil26 July, 2019