Mexico Opens Last Round Of Oil Bidding Before Election

From: Oil Price / Oxford Business Group / 28 April 2017

The latest round of open bidding for exploration rights in Mexico’s energy sector received mixed interest, with two further rights sales to take place later in the year.

Of the 35 shallow offshore blocks on offer in the March 27 auction, 16 were sold, with the strongest interest seen in blocks in the Sureste Basin – in the south-eastern portion of the Gulf of Mexico – where all eight offerings found buyers.

Mexico’s state-owned oil producer, Petróleos Mexicanos (Pemex), won seven of the blocks on offer, one in its own right and six more in partnership with overseas energy firms.

Fourteen oil majors were pre-qualified to bid alongside 22 consortia. France’s Total was the biggest winner in the Sureste Basin, coming away with the largest share of three blocks covering a total of 2342 sq km. It received two of these as part of a consortium with Pemex, and one with BP and Pan American.

The Ministry of Energy estimates that developing and operating the 16 blocks will require investment of $8.6 billion over the lifetime of the deposits.

Related: How High Can Trump Push Oil Prices?

Overall response to the auctions was slightly muted, with local and international majors showing some caution when making offers, partly due to the upcoming presidential election in July 2018, which has sparked concerns about potential changes to energy sector policy and rising supply in the market.

Auctions for shale deposits set for September

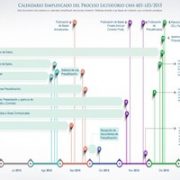

Indeed, the March auction was the first of up to three rights sales to be staged this year, with the remaining two land bids scheduled for late July and early September. The former will cover a total of 37 contractual areas in Burgos, Tampico-Misantla-Veracruz and the Sureste Basin.

The September round of bidding will be particularly notable, as it will be the first time that development rights for shale deposits have been auctioned off in Mexico.

Depleting natural gas reserves and high potential for shale – the country has 545trn cu feet of technically recoverable sources of shale gas, according to the World Resources Institute – have driven Mexico to accelerate development of the industry.

Early last month the energy sector regulator, the National Hydrocarbons Commission (Comisión Nacional de Hidrocarburos, CNH), called for bids on nine blocks in the Burgos Basin – located in the state of Tamaulipas, in the north-west of the country – to be auctioned off in September.

The blocks contain an estimated 1.1 billion barrels of oil equivalent (boe), and winning bidders will have the right to conduct exploratory work for conventional oil and gas, as well as any shale deposits identified.

Energy reform supports private sector development

The successive rounds of auctions for exploration and production rights are the keystone of Mexico’s energy reform policy. Launched in 2013, the reforms ended Pemex’s upstream and downstream monopoly, and offer the country the potential to generate $1trn of foreign direct investment by 2040, according to the Mexican Association of Hydrocarbons Companies.

From: Oil Price / Oxford Business Group / 28 April 2017