Jefferson Energy Companies Originates the First ExxonMobil Unit Trains of Refined Products to Mexico

From: GlobeNewswire / 11 de Diciembre de 2017

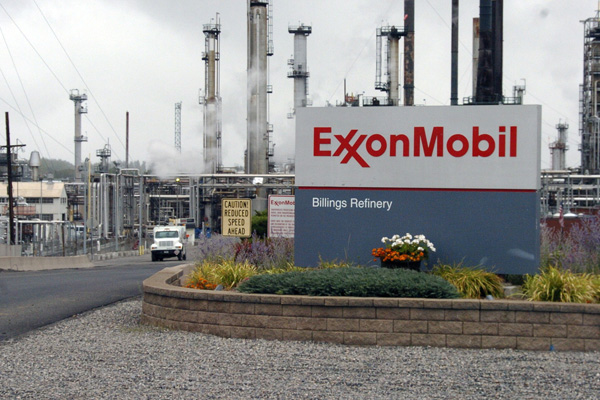

NEW YORK, Dec. 11, 2017 (GLOBE NEWSWIRE) — Jefferson Energy Companies (“Jefferson”), a subsidiary of Fortress Transportation and Infrastructure Investors LLC (NYSE:FTAI), is playing an important role in ExxonMobil’s recent Mexico market entry. With logistics support from Jefferson, ExxonMobil is the first company to provide an integrated product offering along the entire fuels value chain in Mexico. Unit trains of gasoline and diesel delivered to Central Mexican markets originated at Jefferson’s terminal in Beaumont, Texas. The unit train loading was done under an agreement with ExxonMobil. These volumes originated at Jefferson were safely delivered through a destination terminal in San Luis Potosi to retail gasoline stations in the Bajio region. ExxonMobil previously announced its intent to spend $300 million in fuel logistics, product inventories and marketing in support of Mobil-branded stations and Synergy-branded fuels, and these unit train shipments are part of that program.

About the Jefferson Energy Terminal

Jefferson Energy CEO and President Greg Binion said, “We are excited to be an integral part of the transformation of the Mexican energy sector. Further, we are very pleased that ExxonMobil recognized the operational flexibility and advantages that our terminal provides. As this opportunity in Mexico expands, we plan to continue to enter into other contracts to provide logistics for refined products export to Mexico. We also plan to continue to invest in associated tanks as well as rail and loading infrastructure in order to meet the rapidly growing demands of this market.”

The terminal is owned and operated by Jefferson Energy Companies, a midstream oil and terminal company that serves the Gulf Coast. The terminal is located on 243 acres in Beaumont, Texas, positioned in one of the largest refinery markets in the U.S., located in the center of the 9.2 million bbdGulf Coast refining market (PAD III). The terminal is a public-private partnership between the Port of Beaumont Navigation District of Jefferson County, Texas and Jefferson Energy Companies. The Port of Beaumont is the fourth busiest port in the United States, according to the U. S. Army Corp of Engineers tonnage statistics, and the busiest military port in the U.S. The terminal is currently served by three Class I railroad carriers, allowing delivery from most origination terminals and plants in North America.

About Fortress Transportation and Infrastructure Investors LLC

Fortress Transportation and Infrastructure Investors LLC (NYSE:FTAI) owns and acquires high quality infrastructure and equipment that is essential for the transportation of goods and people globally. FTAI targets assets that, on a combined basis, generate strong and stable cash flows with the potential for earnings growth and asset appreciation. FTAI is externally managed by an affiliate of Fortress Investment Group LLC, a leading, diversified global investment firm. For more information about FTAI, visit www.ftandi.com.

Ferrocarril