Tag Archive for: México

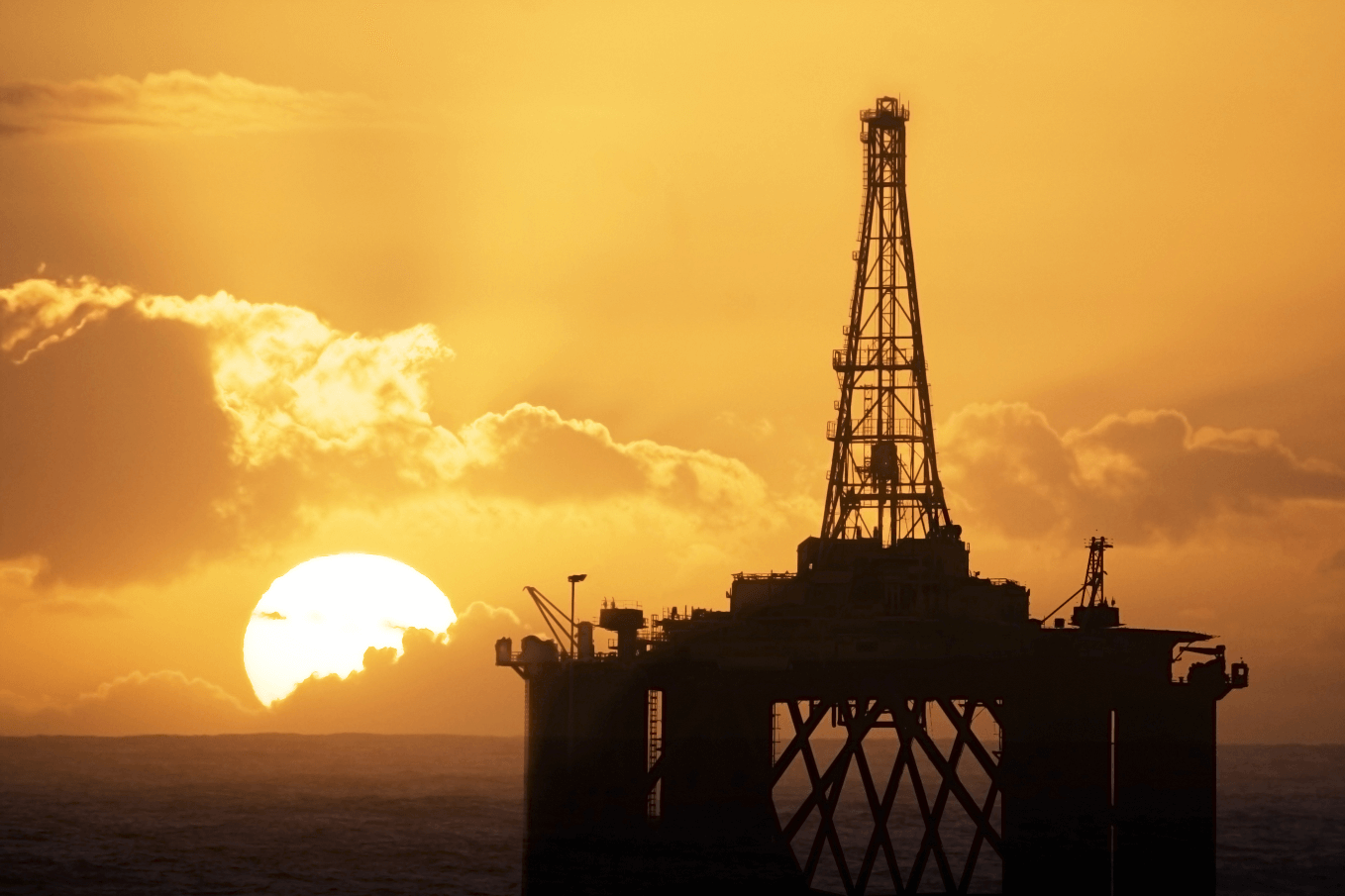

RGU Secures Funding to Help Develop Oil, Gas Workforce in Mexico

/NewsRobert Gordon University (RGU) in Aberdeen has been awarded funding to create a skills development framework for the oil and gas sector in Mexico.

The framework will provide recommendations on how to address the potential skills gap in the Mexican oil and gas industry over the next 15 years, both at graduate and vocational level. The university secured the funding, which will be delivered by the British Embassy in Mexico, from the British Government’s Prosperity Fund.

As part of the development plan, RGU will advise the Ministry of Energy in Mexico (SENER) on appropriate delivery models to train and further develop the Mexican workforce, and to secure a pipeline of future talent.

Work on the development plan has already begun and the framework will be presented to the Mexican Government in December, an RGU spokesperson told Rigzone. In its plan, RGU is undertaking a review of what the UK has done to develop its skilled workforce and is using that information to advise the Mexican Government.

Although Mexico has a long-standing track record as one of the leading hydrocarbon producing countries in the world, it is estimated that it will require more than 135,000 additional skilled people in the oil and gas industry over the next 15 years in order to meet production targets set by the government.

“The Energy Reform in Mexico presents huge opportunities for the Mexican oil and gas sector,” said Professor Paul de Leeuw, director of RGU’s Oil & Gas Institute.

“RGU is delighted to undertake this important review on behalf of the FCO and to advise the Mexican Government on skills development options for Mexico,” he added.

“As part of the Energy Reform, SENER has developed a coordinated strategic human resource program for the energy sector, seeking to rapidly build capacity to respond to the needs of the transformed energy sector,” said Leonardo Beltran, SENER’s undersecretary for planning and energy transition.

“The partnership with the UK and particularly with RGU will support the development of capacity building of Mexico’s oil and gas sector,” he added.

“We aim to build a strong partnership that promotes an open, robustly-regulated Mexican energy sector with significant British collaboration. The UK is a global centre of energy excellence and we hope our experience can contribute to the successful implementation of Mexico’s new energy markets,” said the British Ambassador to Mexico, Duncan Taylor.

The project builds on the relationship RGU has been developing with SENER following the visit from the President of Mexico, Enrique Peña Nieto and his delegation to the university in March 2015, and builds on the Memorandum of Understanding (MoU) which RGU signed with SENER in September 2015.

This project is funded by the British Embassy in Mexico as part of its Prosperity Fund energy program. This program seeks to support Mexico’s economic development and create commercial opportunities in the energy sector. Through the Prosperity Fund, the British Government has supported Mexico to shape its energy legislation based on international best practices.

Copyright: Rig Zone

Mexico Said to Begin Quietly Hedging 2017 Oil Price in June

/NewsMexico started quietly buying contracts to lock in 2017 oil prices when futures were near their peak in June, signaling the start of what has in prior years been the world’s largest sovereign petroleum hedge, according to people familiar with the deal.

The Latin American country bought put options, which give it the right to sell crude at a predetermined price, in June and July, earlier than the usual period of late August to late September, said the people, who asked not to be identified because the process is private.

Brent crude, the global benchmark, peaked at nearly $53 a barrel in early June. Since then, prices have declined about $10 a barrel as the outlook for the global economy soured and OPEC countries boosted production. The people didn’t say how much Mexico was able to hedge before prices fell back.

In response to a list of e-mailed questions, the Mexican Finance Ministry’s press office declined to comment on the status or progress of Mexico’s oil hedge negotiations.

The Latin American country has spent an average of almost $1 billion a year over the past decade buying put options through deals with banks that in the past have included Goldman Sachs Group Inc., Citigroup Inc., JPMorgan Chase & Co., Morgan Stanley, BNP Paribas SA, Barclays Plc and HSBC Holdings Plc, according to government documents. Mexico’s annual hedge is the largest undertaken by a national government and often roils the market.

Mexico and its bankers try to keep the hedge under wraps as long as possible, to avoid others front-running the trade and making the insurance more expensive. In the past two years, however, some details of the hedge emerged because of new regulations introduced in the U.S. with the Dodd-Frank Act.

Dodd-Frank

The rules forced U.S. banks to report some details of the deal through public swap data repositories. But this year not a single deal bearing the marks of the Mexican hedge has emerged, and two of the people familiar with the program said Mexico and its bankers were using non-U.S. branches of the banks to bypass the reporting rules.

The move to hedge 2017 oil prices comes as Mexico stands to take in about $3 billion from this year’s hedge, which was put on from June to August 2015, if prices remain around current levels. That follows last year’s record payout of $6.4 billion.

Despite Mexico’s hedging success — it received $5 billion in 2009 after oil prices plunged — few other commodity-rich countries have followed suit. Ecuador hedged oil sales in 1993, but losses triggered a political storm and the nation never tried again. More recently, oil importers Morocco, Jamaica and Uruguay have bought protection against rising energy prices.

Copyright: Rig Zone

Drafts of Bidding Terms and Production Sharing Contracts for Round 2 Phase 1 –Shallow Waters, were published by CNH

/NewsOn July 20, 2016, the Mexican National Hydrocarbons Commission (CNH) published the drafts of the Bidding Terms and Production Sharing Contracts (PSC) for Round 2, Phase 1, for the Exploration and Extraction of Hydrocarbons in Shallow Waters. Below is a summary of the most important terms and conditions of the drafts of the bidding terms and the PSC.

Shallow Water Blocks

The CNH will bid 15 shallow water blocks, 4 of which are located in the Tampico-Misantla oil province, 1 in Veracruz and 10 in Cuencas del Sureste oil province.

Bidding Terms

-

Interested oil companies may participate in the bid of the 15 blocks, as individual bidders or in consortium.

-

Interested parties and bidders should not be in contact with any official from the CNH or the government that is in any manner related to the Round 2 bids, as bidding terms and contracts should not be subject to negotiation. However, any interested party should be able to make comments related to the bidding terms and contracts through the CNH’s webpage.

-

All stages of the bidding process will take place in Spanish, unless there is a specific provision that states the contrary.

-

Bidding and contract terms, excluding prequalification requirements, might be subject to change at any point in time before their final publication.

-

The bidding process will occur in the following stages: i) publication of bidding terms, ii) access to data rooms, iii) registration, iv) clarifications to the bidding terms, iv) prequalification, v) filing of proposals, vi) awarding of contracts and vii) execution of contracts.

-

The following payments will apply:

Registry fee – $750,000 MXP.

To have access to the data rooms – Information worth at least $8,000,000 MXP.

-

Bidding day is set for March 22, 2017. The chart below illustrates the timeline for the bidding process:

-

To prequalify for the bidding process companies have to demonstrate, among others, the following:

-

Legal origin of funds.

-

Organization Chart

-

Information regarding companies that have control of the company.

-

In case of SPVs, their corporate and business structure must be detailed, indicating who has significant control or influence. Also Tax Returns and Audited Financial Statements of those that incorporated the SPV, corresponding to the last 2 years, should be filed.

-

Some of the requirements will be waived for those that successfully prequalified to Round 1, Phases 1, 2 and 4, as long as they are still the same members of the successfully prequalified bidder in the past phases.

-

Technical requirements are as follows:

Experience as an operator in projects from 2011 to 2015 through (i) the participation in at least three projects of exploration and/or extraction of hydrocarbons, or (ii) capital investments in exploration and/or extraction projects that together amount at least USD $1 billion. . It is not required that the interested company participated as an operator in these projects.

2.Experience as (i) an operator in at least one project of exploration and/or extraction of hydrocarbons in shallow waters and/or deep water or (ii) having participated as partner in at least two projects of exploration and/or extraction of hydrocarbons in shallow waters and/or deep waters in the last 5 years.

3.Experience in industrial and environmental, health and safety programs during the last five years in exploration and/or extraction projects in shallow waters and/or deep wat

-

As for the financial requirements, the operator shall demonstrate economic capacity, meaning the contractor owns assets of at least USD $10 billion and have an investment credit rating or has shareholder’s equity of at least USD $1 billion. If the operator does not meet the above mentioned financial criteria on a stand-alone basis, the operator could participate in a Consortium demonstrating a shareholder’s equity of USD 600,000,000, as long as the other members of the Consortium demonstrate an aggregate shareholders’ equity of USD 400,000,000.

-

Bidders will be able to participate as an individual bidder and/ or as part of one or more consortiums, however, the one bidder cannot participate in more than four consortiums. Proposals are limited to one per contractual area. There are no restrictions for any company to partner with major oil companies, international oil companies or national oil companies, including Pemex.

-

The weighted average of the offer or biding factor to determine the winner will be calculated considering the value of the Participation of the State in the Operating Profit, and the additional investment factor related to the minimum work program, according to the formula provided in the bidding terms.

-

The additional investment factor is related to the additional investment commitment during the exploration period. The variable corresponding to the investment factor could be 1.5 in case of making an additional investment commitment of working units equivalent to two exploratory wells, 1 in case of committing to working units equivalent to 1 exploratory well and 0 if no additional investment commitment is made.

-

Minimum values to be accepted will be determined by Hacienda before the CNH publishes the final version of the bidding terms and contracts, and at that point Hacienda will also define when such values will be public.

-

A USD $500,000 letter of credit should be submitted as bid bond for each offer.

-

Contracts will be awarded on March 24, 2017 and should be executed within 90 days after they are awarded.

Production Sharing Contracts for the Exploration and Extraction of Hydrocarbons in Shallow Waters

-

Production Sharing Contracts will be applicable. Contractors will perform Oil and Gas activities under the PSC, within the contractual area, at their own cost and risk, in exchange of a consideration from the State.

-

The term of the Contracts will be 30 years. The term may be extended for 2 more periods of 5 years each.

-

Contracts include an initial transition phase of up to 120 days. In such period the Contractors must document the status and integrity of the fields and equipment and initiate a social impact and environmental study to establish the base line.

-

Contracts include an initial exploration period of up to 4 years. In such period

-

Contractors will be obliged to finish the minimum work program. The exploration period may be extended for an additional period of 2 years (conditions apply). This additional period could be extended if for causes non attributable to the contractor he is not able to finish the corresponding activities.

-

Contractors will have to file an exploration plan for approval within 120 following the execution date of the contract. CNH will have 120 days to approve it. If the plan is not filed within the established term, a late fee USD 10,000 per day will apply The exploration plan may be adjusted subject to CNH’s approval.

-

Contractors shall file a performance guarantee to cover their obligations related to the minimum work program. The amount of said guarantee will be the result of multiplying the reference value of the work unit by 75% of the work units corresponding to the minimum work program and its increase, or by the number of working units corresponding to the increase of the minimum work program not performed in the initial exploration period and the additional commitment for the additional exploration period.

-

Contractors will have to inform the CNH in case of a discovery within the subsequent 30 days the discovery is confirmed. Once that the Contractors notify the CNH, they will have 60 days to file the appraisal plan.

-

The appraisal plan will have duration of up to 12 months, that could be extended for another 12 months when technical or commercial conditions require it, subject to CNH previous approval.

-

The appraisal plan in case of a nonassociated Natural Gas discovery will have last of up to 24 months that could be extended for 12 additional months when technical or commercial conditions require it, subject to CNH previous approval.

-

Within 60 days after the ending of any appraisal period, contractors will have to inform if the discovery is a “commercial discovery”.

-

Within 1 year after the confirmation of a commercial discovery contractors will have to file the corresponding development plan which shall be approved within 120 days Provisions related to the relinquishment of areas and unifications are included. These provisions will not be understood as a decrease in the Contractor’s obligations to comply with work commitments for the exploration period or its obligations regarding relinquishment activities and other activities set down in the Contract.

-

Contractors will have to keep an Operating Account where transactions related to the contract should be recorded. Additionally, contractors will have the obligation to file budgets of the costs to be incurred during the implementation of each work program and shall comply with the requirements set forth in the PSC.

-

Items included or excluded in the cost recovery and the applicable procedure are properly described in annex 4.

-

Costs resulting from the exploration and production activities will be considered as recoverable costs as long as they comply with the applicable legislation and the guidelines established by Hacienda.

Among the non-eligible and hence, non-recoverable costs established in the PSC, are the following: i)those not included in the budgets and work programs approved by the CNH or those in excess of the costs that were established in the budget elevate it in more than 5% or elevate the budget contemplated for the activity pursuant to the account catalogue over 10%, ii) financial costs, iii)donations, iv)costs for servitudes, rights of way and lease or acquisition of land, v) overhead expenses and vi) arbitration and dispute resolution costs, among others.

Overhead expenses related to services received or activities carried out outside the Mexican territory will be recoverable up to a 1.5% of the authorized budget.

-

The volume of hydrocarbons will be measured at the measurement point which may be inside or outside the blocks. Simultaneous to the filing of the development plan, contractors will have to propose the procedures to store, measure and monitor the quality of the hydrocarbons.

-

Assets generated or acquired by the contractors to carry out the exploration and extraction activities should be transferred to the Government when the contract is terminated. Movable assets, lease assets or assets owned by subcontractors are exempted from the transfer to the extent the transactions were not carried out with related parties.

-

Contractors will be able to commercialize the production by themselves or through third parties.

-

Government take will include the i) Contractual quota for exploration phase, ii) royalties and iii) the percentage of the operating profit that will be adjusted according to an R-factor included in the Contracts.

-

The amounts corresponding to royalties will be determined pursuant to the formulas and values established in the Hydrocarbon Revenue Law (HRL) and will depend on the type of hydrocarbon.

-

The PSC includes a sliding scale system based on IRR (before tax) with an initial benchmark of 25% that starts decreasing the Contractor share until the IRR reaches a benchmark of 40%, leaving a final Contractor share to 25% of the bid value. For computing the IRR, the PSC allows the Contractor to recognize four times its costs linked to the minimum work program and to the increase of the minimum work program.

-

The consideration for the contractor will include i) cost recovery and ii) remaining percentage of the operating profit.

-

The percentage of cost recovery will be 60%. However, if in the contractual area only non-associated natural gas discoveries are made, the percentage will be 80%.In addition, for the determination of the recoverable costs, the eligible costs established in the minimum work program and its increase will be recognized at an additional 25% value.

-

The Contracts include provisions to determine the value of hydrocarbons similar to the ones included in prior rounds.

-

Decommissioning provisions are included. Contractors will have to incorporate an abandonment fund once the development plan is approved. The contractor shall deposit ¼ of the annual amount at the end of each quarter.

-

Local content obligations are included: 15% during the exploration period; 17% during appraisal period and for the development period the percentage will start at 26% and will increase yearly until it reaches 35% in 2025.

-

Contractors shall have insurance policies that cover civil liability, well control and damage to the materials generated or acquired during the exploration and production activities.

Administrative and contractual rescission clauses are included in the Contracts as well as provision related to dispute resolution mechanisms under ICC rules as in prior rounds.

Copyright: Rondas Mexico

Big Oil’s $45 Billion of New Projects Signal Spending Revival

/NewsTwo projects worth $45 billion announced this month show the world’s largest oil companies are regaining the confidence to make big investments, emboldened by rising crude prices and low costs that promise to trigger more expansion ahead.

Chevron Corp. gave the go-ahead to a $37 billion expansion in Kazakhstan, the industry’s biggest undertaking since crude started tumbling two years ago. BP Plc signed off on the $8 billion expansion of a liquefied natural gas plant in Indonesia. Two more big projects are likely to get a green light this year, according to industry consulting firm Wood Mackenzie Ltd. and Jefferies International Ltd. — BP’s Mad Dog Phase 2 in the Gulf of Mexico and Eni SpA’s Coral LNG development off Mozambique.

Crude’s recovery from a 12-year low and a decline in project expenses have emboldened executives to start spending again after cutting more than $1 trillion in planned investments planned investments amid sinking earnings. While protecting balance sheets is important, explorers need to at least begin a new phase of investment in exploration and production to ensure future growth.

“We have seen a recent pick-up, demonstrating that projects deemed strategically important are still going ahead,” said Angus Rodger, a Singapore-based principal analyst for upstream research at Wood Mackenzie. He expects about 10 decisions on midsize to large projects this year from fewer than 10 last year, though still well below the annual average of 40 before oil crashed.

While the price slump hit profit hard, it has also driven down costs of services and equipment, including rigs. Drillers have renegotiated contracts to get better deals from suppliers as reduced demand creates a buyers’ market.

BP has knocked more than half the cost off its Mad Dog Phase 2 project. Estimated at $20 billion four years ago, it’s now expected to cost less than $9 billion, Chief Executive Officer Bob Dudley said last month. Rig-rental rates are likely to stay down because of an oversupply, while low steel prices are reducing the cost of other equipment, he said.

Chevron and its partners including Exxon Mobil Corp. approved the Tengiz expansion after postponing the decision last year as oil prices were falling. Like BP, Chevron estimates it has been able to bring costs down far enough to make the investment viable. Output is expected to start in 2022.

Tengiz “has undergone extensive engineering and construction planning reviews and is well-timed to take advantage of lower costs of oil industry goods and services,” Jay Johnson, executive vice president for upstream at Chevron, said in a statement.

Protecting Dividends

Chevron’s and BP’s investment decisions “are a signal that they’re more confident of their ability to pay their dividend,” said Jason Gammel, a London-based analyst with Jefferies. “It’s showing more confidence” in cash flows.

As earnings fell, companies faced a choice between protecting dividends and cutting investment. The biggest opted to protect payouts, canceling projects and firing thousands of people. While some analysts criticized that strategy, bosses including Ben Van Beurden of Royal Dutch Shell Plc said they were doing what shareholders wanted.

Brent crude rose 0.8 percent to $46.76 a barrel on the London-based ICE Futures Europe exchange on Friday. That’s less than half what it was two years ago. It means earnings remain under pressure and companies are still planning to keep overall expenditures low expenditures low to preserve their balance sheets.

“Big Oil is still going to be conservative in their spending,” said Brian Youngberg, an analyst at Edward Jones & Co. in St. Louis, Missouri. “Those days of several of these big projects going on at the same time are in the past.”

Crude Turnaround

Some, including Ian Taylor, CEO of Vitol Group, the world’s largest independent oil-trading house, believe crude’s recent rise is unlikely to last as demand growth slows. Brent also climbed in the first half of 2015 before sliding more than 40 percent by year-end.

Chevron’s and BP’s plans are for expansions of existing projects rather than something built from scratch. They are easier to push through because they maximize existing infrastructure, said Brendan Warn, a managing director at BMO Capital Markets in London.

By contrast, Eni’s plans to exploit its giant Coral gas discovery off Mozambique include the first newly built floating LNG plant in Africa. Eni CEO Claudio Descalzi said in April he is “practically sure” the company will make a final investment decision this year.

“Unless oil prices do something very drastic and go lower, these companies now have many projects in their portfolios to pick from,” said Iain Armstrong, a London-based analyst at Brewin Dolphin Ltd. “Times have improved.”

Copyright: Bloomberg

Mexico’s Pemex signs MOUs with Arab oil companies

/NewsMexican state-owned energy company Petroleos Mexicanos signed two memorandums of understanding Tuesday with oil companies from the United Arab Emirates.The two MOUs, signed within the context of Mexican President Enrique Peña Nieto’s visit to several Persian Gulf nations, are in addition to a separate agreement inked in Saudi Arabia, Pemex said in a statement.

Under the terms of one MOU with Mubadala Petroleum, the companies will explore potential upstream (exploration and production) and primary midstream (liquefaction and transport) projects in Mexico’s energy sector.

They also will study the potential for cooperating on infrastructure projects, including one in the Salina Cruz area of the southern Mexican state of Oaxaca that would involve an investment outlay totaling more than $4 billion, Pemex said.

Under the terms of the agreement, the two companies also will explore potential cooperation in cogeneration projects.

A second MOU was signed with the company ADNOC and calls for the exchange of best operating practices, including training in areas such as the processing and handling of liquefied natural gas.

Lastly, the MOU with Saudi Arabian company Saudi Aramco lays the groundwork for a dialogue aimed at “exploring different areas of cooperation,” such as upstream and downstream (refining and marketing) operations and support services.

Pemex CEO Emilio Lozoya, who is accompanying Peña Nieto on the visit, signed the three MOUs. EFE

Copyright: Fox News

Wood Mac: Deepwater Gulf of Mexico to be ‘Resilient’ in 2015

/NewsDeepwater Gulf of Mexico (GOM) is proving to be resilient in the face of a sharp decline in oil prices. We expect momentum from 2014, which marked the first year of production growth since 2009, to continue in 2015. Six new projects are expected to come online this year, which are expected to bring an additional 177,000 boe/d in new production. The number of rigs contracted is also close to record levels. Development capex is projected to increase for the fifth year in a row and reach a record level of $14.9 billion. This activity will to lead to a sharp increase in production, which we anticipate to grow 23 percent this year and reach 1.6 mmboe/d.

The robust level of GOM activity is expected to remain buoyant over the short-term due to lower breakeven costs for sanctioned projects. The mix of sunk E&A wells and facility costs creates attractive projects on a point-forward basis. Lucius, Jack/ St. Malo and Tubular Bells all started up in the past six months and had breakevens of US$10-US$50 at first production. The advantage in point-forward breakevens for sanctioned projects is significant compared to some pre-FID projects with breakevens as high as $60-$80/bbl. Additionally, GOM developments are less impacted by short-term oil price uncertainty due to the long life profiles (30-40 years) for typical stand-alone projects. While onshore shale wells can decline as much as 80 percent on an annual basis, the typical offshore well decline is 30 percent.

Due to the massive influx of newbuild rigs in the Gulf, Mobile Offshore Drilling Units (MODUs) are operating at almost record levels with rigs contracted for development drilling leading the activity. Small independent players have less flexibility for shuffling rig activity given portfolios limited in scale. While Majors can re-direct rigs globally within the portfolio, GOM is seen as a core area for several players. The current environment presents a counter-cyclical opportunity for players with strong balance sheets that can capitalise on lower rig and service costs. However, should oil prices remain lower for a prolonged period of time, operators might choose to let rig contracts expire and pull back on Ultra Deep Water (UDW) frontier drilling activity.

In the short term, GOM is expected to defy the overall trend and sentiment in the lower oil price environment, but if oil prices remain depressed for an extended period, the long term outlook of the region changes drastically. Projects like Kaskida, North Platte, Shenandoah, and Tiber have point forward breakevens in the ~$70-80 range as currently modelled. All of these projects possess high development costs, but there is value to be found in the large reserve size. Under our current price forecast, our base case valuation for these fields ranges from $0.6 – 1.5 billion, NPV10. However, if we hold the oil price at $60/bbl permanently, the base case for these fields drops to the range of $-1.7 – 1.1 billion, NPV10.

All four of the aforementioned fields are in the Lower Tertiary play, which is in the very early stages of development. Consequently, development costs are high and well performance is uncertain, making the play most vulnerable should the oil price remain low. The reserves potential in the play is high, but if the projects are uneconomic, it’s possible that operators won’t develop these existing projects, much less continue exploring in the play.

GOM as it stands in the current price environment is bucking the trend of decreased drilling and massive capital spend reductions. However, if the low oil price persists and operators can’t develop unique ways to decrease the capital required for new projects and/or improve recovery rates, projects will slip and it will be difficult for the region to sustain high level of activity and maintain production growth.

Copyright Rigzone

Mexico’s Cemex creates electricity unit to tap into energy reform

/NewsFeb 19 (Reuters) – Mexican cement-maker Cemex said on Thursday it has created an energy division to take advantage of Mexico’s landmark energy reform, and launch power projects that could provide up to 5 percent of Mexico’s electricity requirements within five years.

Cemex has struggled with a large debt load and cost-cutting since an ill-timed $16 billion takeover of Australian rival Rinker in 2007, when the U.S. housing market nosedived.

In recent years the company has been slashing costs and looking to sell assets to regain a coveted investment grade rating. Cemex executives are hopeful that Mexico’s energy reform will be a lucrative new path for the giant cement-maker.

We are very enthusiastic about Mexico’s energy sector future, and we will leverage on our experience in developing projects that benefit the country, Cemex Chief Executive Officer Fernando Gonzalez said in the statement.

The company will invest $30 million in the new unit, to be called Cemex Energia, over the next five years, the statement said.

Cemex also said it had signed a joint venture agreement with Pattern Energy Group Inc, which owns wind power projects, to create 1,000 megawatts of renewable power in Mexico within the next half decade.

In a separate statement, Pattern said new legislation in Mexico, which mandates that 35 percent of Mexico’s power must come from renewable sources by 2024, prompted it to expand into Latin America’s second largest economy.

Mexico’s energy reform, finalized last year, is President Enrique Pena Nieto’s big bet to kick-start Mexico’s long-lagging economy, by bringing private investors into the country’s ailing oil, gas and electricity sectors to stem a 10-year decline in crude output and steep power costs for manufacturers. (Reporting by Cyntia Barrera; Writing by Gabriel Stargardter; Editing by Jeffrey Benkoe)

Copyright Reuteurs

Photo by Secretlondon (Own work)

Latest News

Fundamental factors to strengthen Pemex12 August, 2019

Fundamental factors to strengthen Pemex12 August, 2019 Offshore Project Development: The Road to First Oil26 July, 2019

Offshore Project Development: The Road to First Oil26 July, 2019