Tag Archive for: oil

OPEC member Iran and India – one of Asia’s fastest growing source of energy demand – signed a memorandum of understanding (MoU) to develop oil and gas projects, including the Farzad B gas field, Iranian Petroleum Minister Bijan Zangeneh told the Iran-India business conference held at Teheran Chamber of Commerce Saturday, Shana – a media linked to Iran’s Ministry of Petroleum – reported Sunday. “We had thorough conversations today and signed an MoU for development of Farzad B gas field, refinery cooperation, export of crude oil and petroleum products and mutual cooperation in petrochemical industry,” Zangeneh said.

The MoU was signed during a visit to Teheran by Indian Petroleum and Natural Gas Minister Dharmendra Pradhan, who, the Ministry said on its website April 7, hoped to engage “with the Iranian political leadership to work with them, particularly in the hydrocarbon, petrochemicals and fertilizers sectors for mutual benefits, including strengthening of India’s energy security.” According to Zangeneh, Indian investors should consider the development of the Farzad B project as a top priority, adding that “we hope decisions regarding the project’s development will be made before 2017.”

He said the Farzad B gas field can produce 3 billion cubic feet per day (Bcf/d) of natural gas, but Iran has signed an MoU with Indian developers for the production of 1 Bcf/d of natural gas from the field. A consortium comprising three Indian companies, including ONGC Videsh Ltd. and Oil India Ltd., made a gas discovery at the offshore Farzad B field in 2008.

Meanwhile, Zangeneh said both nations have agreed to set up major joint ventures and enhance their strategic relations, adding that “we hope Iranian and Indian companies reach out to each other and, under the new circumstances, the two countries boost their investments.” Indian companies have indicated to Zangeneh their interests to purchase natural gas from Iran to feed their petrochemical and other energy-consuming industries, Shana reported. On its part, Iran could deliver gas to Indian customers in Chabahar or any other ports where the Indians are willing to invest to feed methanol, steel and aluminium plants.

Separately, shareholders of Turkmenistan-Afghanistan-Pakistan-India (TAPI) Pipeline Company Limited signed an agreement in Ashgabat, Turkmenistan Thursday to invest $200 million in the TAPI natural gas pipeline. According to the Asian Development Bank (ADB), the investment includes funds for detailed engineering and route surveys, environmental and social safeguard studies, and procurement and financing activities, to enable a final investment decision, after which construction can begin. Construction is estimated to take up to 3 years.

According to Pakistan’s Minister of State for Petroleum and Natural Resources Jam Kamal Khan, TAPI would supply 487.3 billion cubic feet (Bcf) or 13.8 billion cubic meters (Bcm) of gas from Turkmenistan to meet the South Asian country’s growing energy demand, Indian daily The Economic Times reported Friday. Sean O’ Sullivan, ADB’s Director General of Central and West Asia Department, said the gas pipeline will unlock economic opportunities and diversify the energy market for Turkmenistan and enhance energy security for the region.

Ground breaking of the 1,127 mile (1,814 kilometer) -long TAPI pipeline, a project seeking to ease energy shortages in South Asia, was carried out in December 2015 year in Turkmenistan. The pipeline will be equipped to transport 3.2 billion cubic feet per day (Bcf/d) or 90 million standard cubic meters a day (MMscm/d) gas for 30 years, with India and Pakistan originally expected to receive 1.3 Bscf/d (38 MMscm/d) each, while the remaining 494.4 million standard cubic feet per day (MMscf/d) or 14 MMscm/d was to be supplied to Afghanistan.

So far, Turkmenistan is the only country that has started work to build its section of the TAPI pipeline. The pipeline will travel 480 miles (773 kilometers) through Afghanistan and 514 miles (827 kilometers) in Pakistan before ending at Fazilka in Punjab, India, The Economic Times said.

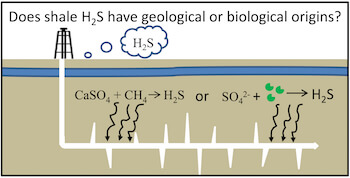

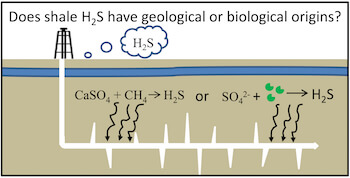

Rice University researchers have developed a technique to model oil and gas formations to determine the cause of souring. Credit: Jason Gaspar/Alvarez Lab

In at least one—and probably many—oil and gas drilling operations, the use of biocides to prevent the souring of hydrocarbons wastes money and creates an unnecessary environmental burden, according to researchers at Rice University.

The Rice lab of environmental engineer Pedro Alvarez reported that soured hydrocarbons found in the Bakken Formation underneath the Northwest United States and Canada are caused by primarily geochemical reactions rather than microbial ones; the researchers questioned the need to pump costly biocides into the well to kill sulfide-producing microbes.

The team’s finding offers a way to cut costs at wellheads where biocides may be unnecessary while keeping them out of the environment, where they may promote the development of biocide-resistant bacteria, Alvarez said.

The research appears in the American Chemical Society journal Environment Science and Technology Letters.

Soured hydrocarbons are those with high concentrations of hydrogen sulfide gas. The hydrogen sulfide gives oil and natural gas the smell of rotten eggs, can be toxic to breathe and is highly corrosive. For this reason, the gas has to be removed from crude oil before it can be transported or refined.

Curtailing the use of biocides when the source of souring is not from microbes would reduce operation costs and mitigate potential impacts to microbial ecosystems, Alvarez said.

The Rice-led team set out to solve a long-standing puzzle over what in an individual formation makes hydrocarbons go sour. Either microbial life or the geochemical environment can catalyze the reaction, but engineers are rarely able to determine which is happening.

Alvarez and his co-authors developed an improved map of temperatures to about 2 miles below the surface in eight representative Bakken Formation fracture wells. They showed that downhole temperatures in the formation are equal to or exceed the upper known temperature limit—252 degrees Fahrenheit—for microorganisms’ survival.

The team also analyzed isotopes of sulfur isolated from hydrogen sulfide taken from the wells. They found all of the isotopes tested suggested geochemical origins. Water samples from the same wells failed to yield DNA concentrations that would indicate the presence of microorganisms.

“The combination of temperature, sulfur isotope and microbial analyses makes scientific, environmental and financial sense,” said Jason Gaspar, a Rice graduate student and lead author of the paper. “Using our method, we could characterize hydrogen sulfide for dozens of wells in a given shale play for less than the cost of adding biocide to one well alone.”

More information: Jason Gaspar et al. Biogenic versus Thermogenic H S Source Determination in Bakken Wells: Considerations for Biocide Application , Environmental Science & Technology Letters (2016). DOI: 10.1021/acs.estlett.6b00075

Oil markets will probably balance by the end of next year, with prices rising in the medium term, according to Sultan Al Jaber, the new head of Abu Dhabi National Oil Co.

Prices, which have swung between highs of about $42 a barrel and lows of about $27 this year, will continue to be volatile in the short term, Al Jaber said in an interview with Abu Dhabi dailies The National and Al Ittihad.

Al Jaber, named the company’s chief executive officer last month, expects “to see a slow but upwards improvement in prices in the medium term,” according to a transcript of his comments published in The National. “2016 and 2017 will be the years during which markets will start to rebalance the gap between demand and supply.”

Abu Dhabi, the capital of the United Arab Emirates, holds about 6 percent of the world’s oil reserves. The U.A.E., a member of the Organization of Petroleum Exporting Countries, is among at least a dozen states that have said they’ll meet in Doha, Qatar, on April 17 to discuss a potential freeze in oil output to stabilize prices. European benchmark Brent crude slipped 0.7 percent to $38.41 a barrel as of 9:34 a.m. in London.

Adnoc, as the state company is known, is taking “into consideration prevailing market conditions” as it works toward a target to boost production capacity to 3.5 million barrels a day, Al Jaber said, without specifying the date when that level would be reached. The company is maintaining its current production level and aims to “remain a reliable supplier.”

The U.A.E. pumped about 2.89 million barrels a day last month, according to data compiled by Bloomberg. Abu Dhabi had been seeking to boost capacity to 3.5 million barrels daily by the end of 2017, while company officials have said the target may not beachieved until 2019.

Oil prices edged up in Asia on Monday, recovering slightly from last week s decline, but analysts said traders would likely delay any big moves until next month s meeting of key producers.

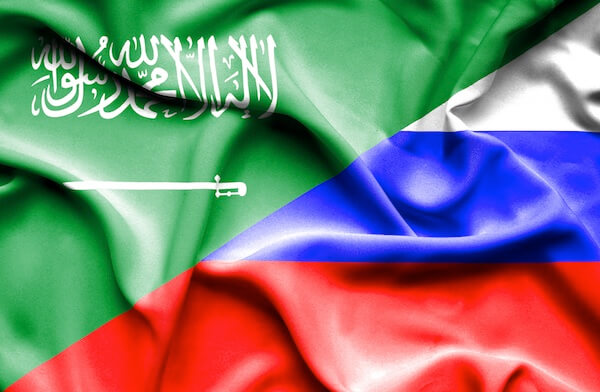

Hopes for an agreement between Russia, Saudi Arabia and other crude giants to at least freeze output sent both main contracts racing above $40 earlier this month, helped by a dive in the strength of the dollar.

At around 0620 GMT US benchmark West Texas Intermediate was up 50 cents, or 1.27 percent, to $39.96. Brent was up 45 cents, or 1.11 percent, at $40.89.

Members of the Organization of the Petroleum Exporting Countries (OPEC) and key non-members led by Russia are due to discuss a proposed output freeze at a meeting in Doha on April 17.

Bernard Aw at IG Markets told AFP a dip in the number of US oil rigs in operation provided some buying incentives, although business had been slim due to the long Easter break across most world markets.

However, he warned that “the fundamental picture of oil is still a little bit bearish” owing to a global supply glut and a slowdown in the global economy, particularly China.

“Everything hinges on the meeting between OPEC and non-OPEC producers,” Aw said. “If it takes place and they come to some agreement of a production freeze, we could see some gains well beyond $40.”

Qatar s energy minister Mohammed al-Sada, who also serves as OPEC president, earlier said the initiative was backed by 15 countries accounting for 73 percent of worldwide output.

Sanjeev Gupta, who heads the Asia-Pacific oil and gas practice at professional services firm EY, said traders would also be looking at upcoming US and Chinese economic data for direction.

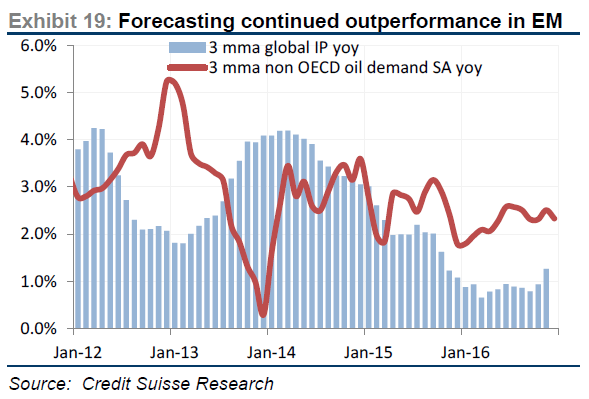

Even as U.S. oil production started to slide in the second half of 2015, the downside risks to oil prices continued to dominate.

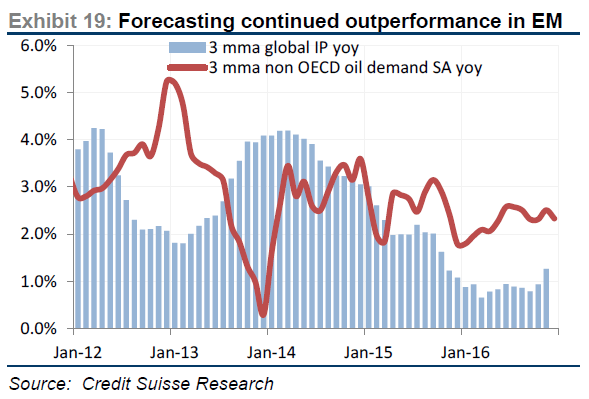

In the third quarter, broad-based manufacturing softness and financial market turmoil threatened to derail growth in developed markets, bringing some focus back to the demand side of the ledger. Annual oil demand growth proceeded to drop off in the fourth quarter from above 2 percent to 1.2 percent with acute cracks in China and advanced economies, seemingly confirming analysts’ worst fears.

But Credit Suisse Group AG Global Energy Economist Jan Stuart concludes that oil demand “growth appears to be re-accelerating” in 2016, with the recent bout of softness attributable to a warm winter, subdued activity in resource-extracting industries, and persistent weakness in select sputtering emerging markets like Russia and Brazil.

“Oil demand growth is alive and well,” he writes in a recent note. “We think that with hindsight this winter will look like a dip in an otherwise still unfolding fairly strong growth trend that is partly fueled by the ongoing economic recovery of in North America and Europe and longer standing trends across key emerging market economies.”

While concerns about global growth linger, demand for crude doesn’t match the narrative that a worldwide recession is imminent. In particular, for the world’s two largest economies, the U.S. and China, Stuart notes that oil demand growth has rebounded following a sluggish fourth quarter.

“While on balance oil demand growth appears relatively sluggish still in the first quarter; February data either improved on January (e.g. Brazil, the U.S.); or extended strong growth (e.g. India, South Korea), while in China demand appeared to have rebounded as well,” he writes.

Demand for oil has been increasingly attributable to passenger vehicles rather than its use as an input in the production process, as the middle classes in emerging markets swell.

In light of this, Credit Suisse anticipates that crude demand will keep running hotter than industrial production:

“We forecast modestly re-accelerating demand growth over the course of this year, so long as a recession continues to be avoided,” asserts Stuart. “We project in fact that oil demand should continue to outperform historic correlations with industrial production.”

This outlook for demand bolsters the analyst’s confidence that oil prices could hit $50 per barrel in May.

Oil fell around 3 percent on Monday after Iran dashed hopes of a coordinated production freeze any time soon, returning bearish sentiment over a supply glut that has sent prices crashing.

Global benchmark Brent crude futures LCOc1 fell back below $40 a barrel, trading at $39.27 at 1308 GMT, down $1.12 on Friday’s close. Brent hit a 12-year low of $27.10 in January.

U.S. crude CLc1 was down $1.09 at $37.41 a barrel.

“Oil is down because Iran said they would only join the output freeze group once they reached production of 4 million barrels a day,” said Tamas Varga, oil analyst at London brokerage PVM Oil Associates.

He was referring to comments by Iran’s oil minister Bijan Zanganeh on Sunday that the OPEC member would join discussions after its output reached that level.

Iran’s oil exports are due to reach 2 million bpd in the Iranian month that ends on March 19, up from 1.75 million in the previous month, he said.

Zanganeh met Russian counterpart Alexander Novak in Tehran on Monday but talks focused on long-running discussions about an oil and gas swap mechanism.

According to the Shana news agency, Zanganeh said Iran and Russia could cooperate on the swap, which would see Russia send oil and gas to northern Iran in return for Iranian supply to Russian customers in the Gulf.

Saudi Arabia appeared to have stuck to a preliminary deal with some other producers to freeze output, as its crude production held steady in February at 10.22 million barrels per day (bpd), an industry source told Reuters.

OPEC members and non-OPEC producers are likely to meet again in mid-April in Doha to discuss freezing output, OPEC sources told Reuters.

A March 20 meeting in Russia, which was part of an earlier plan, now looks unlikely.

Worries about demand fundamentals moved back into the spotlight as investment bank Morgan Stanley warned that a slowing global economy and high production would prevent any sharp rises in oil prices.

“Oil prices now seem to have bottomed, even though they are likely to stay subdued for the rest of this year before starting to move higher in 2017,” the U.S. bank said in a research note. It added that cheap oil had not provided the boost to growth that many had hoped for.

In a sign that investors are growing more skeptical about a rebound in oil prices, ICE data showed on Monday that speculators had cut net long positions in Brent crude by 9,500 contracts in the week to March 8.

Bjarne Schieldrop, chief commodities analyst at SEB Markets in Oslo, said a roughly 2 million bpd oil surplus would weigh down oil prices in the short term. The imminent restart of a pipeline between Iraq and Turkey and the breakdown in talks about a production freeze would add further downside, he said.

“We are likely to see $35 a barrel before we see $45 a barrel.”

Major oil producers are likely to meet in April to discuss a proposal to freeze output at January levels to stabilize the market, according to four Gulf OPEC delegates.

Ministers from some members of the Organization of Petroleum Exporting Countries had suggested that such a meeting would take place this month in Russia. The talks are now most likely to occur in Qatar’s capital Doha, said three of the delegates, who asked not to be identified because the matter isn’t public.

The probability that Doha will play to host the meeting is high as Qatar is president of the OPEC ministerial conference this year, even as Russia is the country that called for the meeting, two of the delegates said. The meeting may still not take place if there aren’t many important producers attending and agreeing beforehand to freeze production, three delegates said.

Saudi Arabia, Russia, Venezuela and Qatar in February proposed an accord to cap oil output and reduce a worldwide surplus. Crude prices extended gains after their initial meeting on Feb. 16 and have climbed more than 40 percent since slumping to a 12-year low in January. Prices may have passed their lowest point as shrinking supplies outside OPEC and disruptions inside the group erode global oversupply, the International Energy Agency said on March 11.

Russia-Iran Talks

Iran plans to boost crude output to 4 million barrels a day, the highest level since 2008, before it will consider joining other suppliers in seeking ways to re-balance the global oil market. Russian Energy Minister Alexander Novak met Monday with Iranian Oil Minister Bijan Zanganeh in Tehran.

Saudi Oil Minister Ali al-Naimi said last month in Houston that the process of devising a freeze agreement would continue with more discussions in March. Nigerian Petroleum Minister Emmanuel Kachikwu said two weeks later that talks would convene in Russia on March 20. Russia’s Novak told state television channel Rossiya 24 on March 4 that a meeting could take place between March 20 and April 1 in Russia, Doha or Vienna, where OPEC has its headquarters.

So far no countries have received invitations or an agenda for a meeting, the four OPEC delegates said.

The Monte Toledo oil tanker covered the uneventful voyage from Iran to Europe with a haul of 1 million barrels of crude in just 17 days, but its journey has been four years in the making.

On Sunday, the tanker became the first to deliver Iranian crude into Europe since mid-2012, when Brussels imposed an oil embargo in an attempt to force the Middle Eastern nation to negotiate the end of its nuclear program. The ban was lifted in January as part of a broader deal that ended a decade of sanctions.

The 275-meter (900-foot) tanker started offloading its cargo into a refinery owned by Cia. Espanola de Petroleos, near Algeciras, a few miles from Gibraltar. By midday, the vessel had already pumped to shore about a fifth of its cargo.

Jose Ramon Gomez Estancona, the captain of the Monte Toledo, said loading the crude at the Kharg Island terminal off Iran was a similar process to before the embargo. Staff at the port were “happy that normality was returning” to the country’s oil exports, he said.

In southern Spain, the tanker’s arrival was met with little fanfare. It was a quiet Sunday at the refinery, and for the workers, the Monte Toledo is just one of the eight or so vessels they expect to receive this month. By the time the refinery has taken in all the Iranian crude, another tanker from Algeria will already be waiting.

Rouhani Ambitions

Nonetheless, there’s a wider significance. As the Monte Toledo started to pump to shore through two 21-inch floating hoses connected to a giant buoy and a 1.8-kilometer submarine pipeline, Iranian President Hassan Rouhani declared in Tehran that more oil exports “will be added soon.”

Ali Tayebnia, the country’s minister of economy and finance, said Iran’s oil exports will “soon return” to 2 million barrels a day. “Arrangements have been made for the return of Iran to the market,” he said, according to Shana, the Oil Ministry’s news service.

Around Europe, other tankers with Iranian oil are close behind the Monte Toledo. In February, 29 vessels loaded crude from the Middle Eastern nation, according to data compiled by Bloomberg. Of those, three are heading toward Europe — the Eurohope tanker is sailing to Constanta, an oil port in Romania, and the Atlantas is on its way to France. Another one, the Distya Akula, is anchored at the mouth of the Suez Canal, and is likely to head into a Mediterranean port.

Export Recovery

The Monte Toledo and its companions are the vanguard in the return of Iran into the European oil market. Petro-Logistics SA, a Geneva-based tanker-tracking firm, estimated Iran exported about 1.4 million barrels a day in February, up 350,000 barrels a day from the average 2015 level.

Although the increase falls short of the 500,000 barrels a day that Tehran had promised, there are signs that exports into Europe will pick up this month.

“It does take a while to get those fields back up,” said Petro-Logistics director Daniel Gerber. “But I think they’re going to hit the increase of 500,000 barrels a day in March.”

Seth Kleinman, head of energy research at Citigroup Inc. in London, agreed, saying that in addition to higher export volumes this month, more countries were buying.

“You see tankers going to Spain, Romania, Tanzania, France and the U.A.E.,” he said. “You got an uptick to India in February too.”

Still, hurdles remain. Lingering banking restraints mean some customers are finding it hard to transfer payments for Iranian crude and National Iranian Oil Co. has offered to swap crude for gasoline to get deals done, according to local reports.

Iran will want to win back customers in Europe, where Russia, Saudi Arabia, Iraq and other rival suppliers stepped in after the embargo was imposed. Tehran also faces a rival unknown four years ago: the U.S. has started exporting crude and companies such as Exxon Mobil Corp. are shipping American oil into refineries in the Mediterranean.

Before the embargo Europe imported on average about 400,000 barrels of oil a day from Iran, according to the International Energy Agency. Cepsa alone was buying about 60,000 barrels a day. Total SA was among the biggest purchasers and the French company is waiting to receive the Atlantas tanker later this month at its refinery in Le Havre. Other European top buyers in the past, including Repsol SA, Eni SpA and Hellenic Petroleum SA, have yet to purchase any.

If all goes as Tehran has planned, the Middle Eastern country will boost its production back to the 3.6 million barrels a day it pumped in 2011. After the European embargo was imposed and the U.S. tightened other sanctions, Iranian output dropped to about 2.8 million barrels a day. In February, the nation pumped 3 million barrels a day for the first time since July 2012, according to data compiled by Bloomberg.

Brent oil prices hit a high for the year above $40 a barrel on Monday after data showed a smaller-than-expected build in U.S. crude stockpiles, helping U.S. stocks extend recent gains.

Brent was last up $1.87 at $40.59, while U.S. crude rose $1.58 to $37.50.

That lifted shares of energy stocks, which led gains in the S&P 500. The energy index climbed 1.5 percent. Biotechs also rallied, helping to support the broader market.

The Dow Jones industrial average was up 65.23 points, or 0.38 percent, to 17,072, the S&P 500 had gained 3.86 points, or 0.19 percent, to 2,003.85 and the Nasdaq Composite had added 9.78 points, or 0.21 percent, to 4,726.80.

MSCI’s all-country world stock index edged up 0.2 percent. In Europe, the pan-regionalFTSEurofirst 300 index provisionally closed down 0.3 percent.

The euro tumbled against the dollar before Thursday’s ECB meeting at which policymakers are expected to cut interest rates further into negative territory.

The euro was 0.5 percent lower at $1.0950 and down 0.7 percent at 124.34 yen. The U.S. dollar index was down 0.2 percent.

“The U.S. economy is doing relatively well. The dollar will likely hang on to its gains right now,” said Sireen Harajli, currency strategist at Mizuho Corporate Bank in New York.

In the U.S. bond market, U.S. Treasury yields rose in volatile trading as traders increased bets the Federal Reserve will raise interest rates this year in the wake of a strong February jobs report and ahead of a ECB meeting.

Friday’s payrolls data showed 242,000 jobs were created last month and assuaged fears the U.S. economy could be headed into recession. It also revived prospects of further Federal Reserve interest rate hikes this year, something markets had priced out.

The benchmark 10-year note’s yield rose to 1.918 percent, its highest in just over a month. It was last down 9/32 in price to yield 1.9127 percent, up from 1.883 percent late on Friday.

Despite heavy rains, more than 300 guests gathered at the Houstonian Hotel on Feb. 23 for HBJ’s Conversation with Houston’s Energy Leaders breakfast. The heavy rain served as a metaphor for the current state of the oil industry, and energy leaders offered their take on how to weather the storm for the rest of 2016.

The three panelists approached the current energy market with three different perspectives. Maynard Holt, co-president and co-head of investment bank Tudor, Pickering, Holt & Co., is bullish on the market over the next year, saying that oil could move to between $42 and $50 a barrel, which could open the market to a flurry of activity.

“We’ll be sitting here not too long from now saying, ‘Wow, that hurt, but it’s over and look at all the good things that are happening,'” Holt told the crowd.

And Ron Wagnon, president of Greenwell Energy Solutions, argued that the energy downturn will be a positive for the market in the long run and that it actually needed to happen. His company has been acquisition heavy over the past few years and isn’t shying away from a deal this year either.

“There’s a lot of opportunity out there,” Wagnon said. “The challenge in today’s market is creating a value for the businesses and trying to find flexibility — without access to cash — to do equity trades to bring businesses in the portfolio.”

One of the significant issues with today’s oil downturn is the difference in fortune between the upstream and downstream portions of the industry, Ken Medlock, senior director of the center for energy studies at Rice University’s Baker Institute, said. For those in upstream, the downturn has hit hard, however, the downstream market is doing well if not thriving. Regardless, the Bayou City will still continue to grow economically.

“Houston will weather this storm. The economy will continue to evolve, the energy space will continue to evolve, and Houston will be at the center of that,” Medlock said. “There’s been a lot of interest — particularly from the press — whether or not the transformation of the energy sector will make Houston obsolete, and I would say no, there’s no way that’s going to happen.”

Scroll to top

Breaking Barriers and Building the Future18 March, 2025

Breaking Barriers and Building the Future18 March, 2025 Fundamental factors to strengthen Pemex12 August, 2019

Fundamental factors to strengthen Pemex12 August, 2019 Offshore Project Development: The Road to First Oil26 July, 2019

Offshore Project Development: The Road to First Oil26 July, 2019