Tag Archive for: west texas

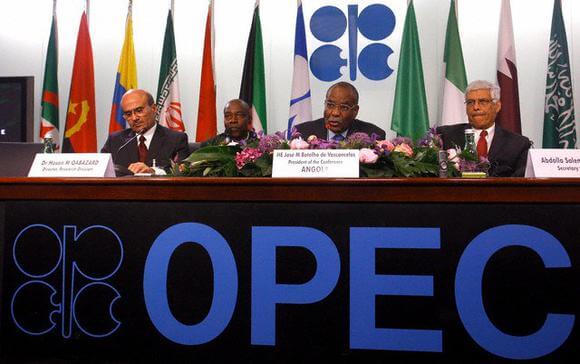

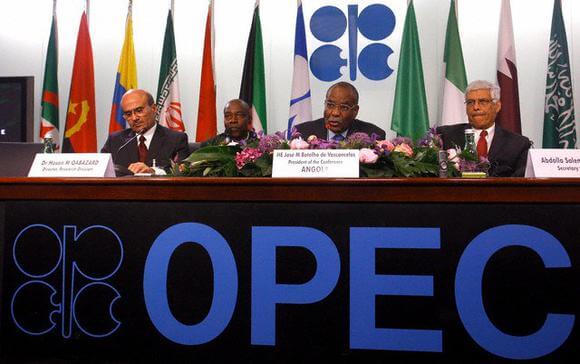

OPEC appears to have persuaded investors that it’s making good on promised production cuts.

Money managers are the most optimistic on West Texas Intermediate oil prices in at least a decade as the Organization of Petroleum Exporting Countries and other producers reduce crude output. Saudi Arabia has said more than 80 percent of the targeted reduction of 1.8 million barrels a day has been implemented. Oil shipments from OPEC are plunging this month, according to tanker-tracker Petro-Logistics SA.

“All the signs are pointing to a pretty significant OPEC cut,” Mike Wittner, head of commodities research at Societe Generale SA in New York, said by telephone. “Until this week we were only getting data from the producers, now the tanker traffic seems to be supporting this view.”

OPEC will reduce supply by 900,000 barrels a day in January, the first month of the accord’s implementation, said the Geneva-based Petro-Logistics. That’s about 75 percent of the cut that the producer group agreed to make. Eleven non-members led by Russia are to curb their output in support.

Hedge funds boosted their net-long position, or the difference between bets on a price increase and wagers on a decline, by 6.1 percent in the week ended Jan. 24, U.S. Commodity Futures Trading Commission data show. WTI rose 1.3 percent to $53.18 a barrel in the report week. The U.S. benchmark slipped 1.1 percent to $52.57 at 10:52 a.m.

OPEC members Saudi Arabia, Kuwait and Algeria have said they’ve cut output this month by even more than was required, while Russia said it’s also curbing production faster than was agreed. Saudi Energy Minister Khalid Al-Falih said Jan. 22 that adherence has been so good that OPEC probably won’t need to extend the accord when it expires in the middle of the year.

Shale Headwind

The OPEC-engineered price rally has spurred a surge in drilling in the U.S. shale patch. Rigs targeting crude in the U.S. rose by 15 to 566 last week, the highest since November 2015, according to Baker Hughes Inc.

“There’s one headwind in the oil market: increased U.S. shale production,” Jay Hatfield, a New York-based portfolio manager of the InfraCap MLP exchange-traded fund with $175 million in assets, said by telephone. “U.S. output in 2017 will be 1 million barrels a day higher than last year.”

U.S. crude production climbed to 8.96 million barrels a day in the week ended Jan. 20, the highest since April, according to the Energy Information Administration. That’s already closing in on the EIA’s latest 2017 output forecast of 9 million barrels a day that was issued Jan. 10.

The net-long position in WTI rose by 21,429 futures and options to 370,939, the most in data going back to 2006. Longs rose 3.7 percent to a record high, while shorts slipped 11 percent.

In the Brent market, money managers reduced the net-long position by 3.1 percent to 448,352 during the week, according to data from ICE Futures Europe. Longs slipped, while shorts rose.

In fuel markets, net-bullish bets on gasoline fell 3.4 percent to 61,511 contracts as futures decreased 1.5 percent in the report week. Money managers increased wagers on higher ultra-low sulfur diesel prices by 1.3 percent to 34,978 contracts, while futures slid 0.4 percent.

“For the time being the market is more focused on the OPEC cuts than about how fast U.S. shale drillers are returning,” Wittner said. “There may come a point soon when the support provided by OPEC will be outweighed by the prospect of rising U.S. production. When that happens there will be a big shift in investor sentiment.”

Copyright: Bloomberg

Geologists say a new survey shows an oilfield in west Texas dwarfs others found so far in the United States, according to the US Geological Survey.

The Midland Basin of the Wolfcamp Shale area in the Permian Basin is now estimated to have 20 billion barrels of oil and 1.6 billion barrels of natural gas, according to a new assessment by the USGS.

That makes it three times larger than the assessment of the oil in the mammoth Bakken formation in North Dakota.

The estimate would make the oilfield, which encompasses the cities of Lubbock and Midland — 118 miles apart — the largest “continuous oil” discovery in the United States, according to the USGS.

“This oil has been known there for a long time — our task is to estimate what we think the volume of recoverable oil is,” assessment team member Chris Schenk told CNN – affiliate KWES Wednesday.

The term “continuous oil” refers to unconventional formations like shale, in which the oil exists throughout the formation and not in discrete pools. The USGS estimates how much oil is considered to be undiscovered but technically recoverable.

“Even in areas that have produced billions of barrels of oil, there is still the potential to find billions more,” Walter Guidroz, coordinator for the USGS Energy Resources Program said in a statement. “Changes in technology and industry practices can have significant effects on what resources are technically recoverable, and that’s why we continue to perform resource assessments throughout the United States and the world.”

Oil has been produced in the Wolfcamp area since the 1980s by traditional vertical wells — but now companies are using horizontal drilling and hydraulic fracturing to tap the continuous oil reserve. More than 3,000 horizontal wells are currently operating, according to the USGS.

Morris Burns, a former president of the Permian Basin Petroleum Association, told KWES the low price of oil — currently around $46 a barrel — means the oil will sit underground for the foreseeable future.

“We are picking up a few rigs every now and then but we won’t see it really take off until we (get) that price in the $60 to $65 range,” Burns told the station.

“When we talk about that many millions of barrels of oil in the ground, that doesn’t mean we can recover it all. We recover in the neighborhood of 50 to 60 percent,” Burns said.

Last spring, CNN reported that “fracking” now accounted for more than half of all U.S. oil output. Back in 2000, there were just 23,000 fracking wells pumping about 102,000 barrels of oil a day. Last March there were 300,000 fracking wells, churning out 4.3 million barrels per day.

The fracking production, led by Permian Basin, Bakken formation and Eagle Ford, also in Texas, caused oil prices to tumble — making the $100 barrel ancient history — to as low as $25 a barrel early this year.

Copyright: CNN

Oil investors must be getting dizzy.

In the two months since OPEC began talking about capping production, speculators’ sentiment has swung wildly, with government and exchange data showing the four biggest weekly position changes ever for the two global benchmark crudes. The latest shift is to optimism, with money managers the most bullish on West Texas Intermediate oil in two years.

“Since the summer we’ve had big moves in net length,” said Mike Wittner, head of oil-market research at Societe Generale SA in New York. “It usually has trended up or down over a couple of months. Now this is happening in a matter of weeks. We’re seeing huge shifts.”

Money managers reduced bets on lower WTI prices by more than half in the past three weeks as OPEC agreed to its first deal to cut output in eight years. That drove net length to the highest since July 2014 in the week ended Oct. 11, Commodity Futures Trading Commission data show. Brent longs also rose, leaving the combined length of the two benchmark contracts at the highest in at least five years.

The Organization of Petroleum Exporting Countries agreed on Sept. 28 in Algiers to trim output to a range of 32.5 million to 33 million barrels a day, which is due to be finalized at the Vienna summit next month. OPEC took a step toward coordinated supply curbs with Russia last week and will meet for a “technical exchange” to set a road map for output levels later this month.

The swings in sentiment have tracked the rocky road to $50 a barrel oil. Speculators’ combined WTI and Brent crude net position rose or fell more than 100,000 contracts four times in the past two months, the only moves of that size in CFTC and ICE Futures Europe data going back to 2011.

Prices began to rise after OPEC’s president said Aug. 8 that the group would hold informal talks in Algiers and Saudi Arabia signaled Aug. 11 it was prepared to discuss taking action to stabilize markets. Futures gave up most of those gains amid doubts that Saudi Arabia and Iran to reach an deal, before the agreement in Algiers sparked the latest rally.

“The change in tone from the Saudis is important,” said Kurt Billick, the founder and chief investment officer of Bocage Capital LLC in San Francisco, which manages about $432 million in commodities equities and futures. “Getting to a yes in Vienna is challenging. That they are willing to talk about a deal is a big change.”

Money managers’ short position in West Texas Intermediate crude, or bets on falling prices, shrank by 28 percent to 71,407 futures and options. Longs rose 1.8 percent to the highest since June 2014. The resulting net-long position increased 13 percent.

WTI increased 4.3 percent to $50.79 a barrel in the report week. Prices on Monday were down 0.6 percent at $50.04 a barrel as of 9:13 a.m.

Other Markets

In the Brent market, money managers boosted net longs by 11 percent to 396,694 during the week, according to data from ICE Futures Europe. It was the most bullish total since April.

In fuel markets, net-bullish bets on gasoline rose 19 percent to 36,650 contracts, the highest since March 2015, as futures slipped 1.1 percent in the report week. Wagers on higher ultra low sulfur diesel prices climbed 46 percent to 9,074. Futures rose 2.1 percent.

The scale of the internal differences OPEC must resolve before securing a deal to cut supply was revealed Oct. 12 as the group’s latest output estimates showed a half-million-barrel difference of opinion over how much two key members are pumping.

“The bottom line is that they’ve made an agreement,” Wittner said. “If you are going short you are betting against the Saudis, which isn’t a good thing historically.”

The longer OPEC and other producers talk about a ceiling on crude output, the more doubts grow in the market.

Money managers increased wagers on falling prices by the most in three months as a meeting between Russia and Saudi Arabia ended without specific measures to support prices. Producers have pledged to discuss action in Algiers later this month.

“The more they talk, the less people listen,” said Michael D. Cohen, an analyst at Barclays Plc in New York. “If you look at the actual statements from the Saudis, there’s not a lot of enthusiasm. They’re saying that either they don’t believe a substantial intervention is needed right now or that if other producers want a freeze, they’ll go along.”

Saudi Arabia’s Energy Minister Khalid Al-Falih said on Sept. 5 that he’s optimistic producers will agree to cooperate in Algiers. He spoke after meeting with his Russian counterpart, Alexander Novak, at the G-20 summit in China. Novak said that a freeze in production by OPEC and Russia would be the most effective way of stabilizing the market.

The International Energy Forum, including 73 countries that account for about 90 percent of the global supply and demand for oil and natural gas, will meet in the Algerian capital Sept. 26-28. The Organization of Petroleum Exporting Countries will hold informal talks on the sidelines of the gathering.

Parsing Words

“Everyone is sifting for clues on whether OPEC will reach an agreement to limit production or leave it uncapped with the potential for higher output,” said Tim Evans, an energy analyst at Citi Futures Perspective in New York. “At this point we’re waiting for the outcome of the talks. A lot of people are standing to the side while others are building positions with a specific view in mind.”

A freeze deal between OPEC members and other producers was proposed in February. A meeting in April ended with no accord because Iran refused to join, while Saudi Arabia insisted that its rival take part. Iran has said it’s too soon to cap output as it’s still restoring production curbed by sanctions.

Speculators bolstered their short position in West Texas Intermediate crude by 34,954 futures and options during the week ended Sept. 6, according to the Commodity Futures Trading Commission. Bets on rising prices declined.

Prices Drop

WTI futures dropped 3.3 percent to $44.83 a barrel in the report week and prices lost 1.6 percent to $45.15 at 9:18 a.m. New York time.

Futures surged Sept. 8 after the Energy Information Administration reported U.S. crude inventories fell 14.5 million barrels in the week ended Sept. 2, the biggest drop since January 1999. Prices retreated the next day as speculation grew the supply drop was a one-off caused by a tropical storm that disrupted imports and offshore production.

Money managers’ short position in WTI climbed to 130,274 futures and options. Longs fell 1.9 percent. The resulting net-long position dropped 19 percent. Net-long positions in Brent crude decreased by 37,226 contracts, according to ICE Futures Europe.

In other markets, net-bullish bets on gasoline declined 32 percent to 11,148 contracts. Gasoline futures dropped 9.1 percent in the report week. Net-long wagers on U.S. ultra low sulfur diesel tumbled 56 percent to 9,840 contracts. Futures declined 4.3 percent.

Gambling Momentum

“There’s a lot of gambling taking place,” said Stephen Schork, president of the Schork Group Inc., a consulting company in Villanova, Pennsylvania. “A lot of money managers are betting that a bottom has been put in but I’m skeptical.”

U.S. crude stockpiles remain at their highest seasonal level in more than 20 years. Refineries plan maintenance programs for September and October when fuel demand is lower. Over the past five years, refiners’ thirst for oil has dropped an average of 1.2 million barrels a day from July to October.

“The market will probably yo-yo in a range through the maintenance season but there’s downside risk,” Schork said. “If demand isn’t a strong as hoped and crude inventories rise, the market could take another leg lower.”

OPEC has done it again.

Talk of a potential deal to freeze output helped push oil close to $50 a barrel and prompted money managers to cut bets on falling prices by the most ever. West Texas Intermediate, the U.S. benchmark, went from a bear to a bull market in less than three weeks.

OPEC is on course to agree to a production freeze because its biggest members are pumping flat-out, said Chakib Khelil, the group’s former president. Saudi Energy Minister Khalid Al-Falih said that the talks may lead to action to stabilize the market.

“This is all courtesy of some very well-timed comments from the Saudi oil minister,” said John Kilduff, partner at Again Capital LLC, a New York hedge fund focused on energy. “They’ve been successful over the last year in jawboning the market, and this is the latest example.”

Hedge funds trimmed their short position in WTI by 56,907 futures and options during the week ended Aug. 16, the most in data going back to 2006, according to the Commodity Futures Trading Commission. Futures rose 8.9 percent to $46.58 a barrel in the report week and closed at $48.52 a barrel on Aug. 19. WTI is up more than 20 percent from its Aug. 2 low, meeting the common definition of a bull market.

“This was a very short market so we were bound to get some covering,” said Stephen Schork, president of the Schork Group Inc., a consulting company in Villanova, Pennsylvania. “You probably won’t hear a lot from OPEC with prices up here, but if we get down to where we were a few weeks ago we can expect to hear more.”

Informal Talks

The Organization of Petroleum Exporting Countries plans to hold informal talks to discuss the market at the International Energy Forum next month in Algiers. Russian Energy Minister Alexander Novak said that the nation was open to discussing a freeze.

Talks to implement a production freeze collapsed in April when Saudi Arabia said it wouldn’t take part without Iranian participation. Iran was restoring exports after sanctions over its nuclear program were lifted in January.

Saudi Arabia, Iran, Iraq and non-member Russia are producing at, or close to, maximum capacity, Khelil said in a Bloomberg Television interview on Aug. 17. Saudi Arabia told OPEC that its production rose to an all-time high of 10.67 million barrels a day in July, according to a report from the group.

Ample Stockpiles

Declining crude and gasoline stockpiles in the U.S. also bolstered the market last week. Crude supplies dropped by 2.51 million barrels as of Aug. 12, Energy Information Administration data show. Gasoline inventories slipped 2.72 million barrels during the period. Stockpiles of both crude and gasoline remain at the highest seasonal levels in decades even after the declines.

“There’s a high level of uncertainty right now, so fairly small news can move the market a lot,” said Michael Lynch, president of Strategic Energy & Economic Research in Winchester, Massachusetts. “It still remains the case that we have a huge surplus of supply and aren’t going to see it disappear anytime soon.”

Money managers’ short position in WTI dropped to 163,232 futures and options. Longs, or bets on rising prices, increased 0.1 percent, while net longs advanced 56 percent, the most since July 2010.

In other markets, net-bearish bets on gasoline climbed 54 percent to 1,970 contracts. Gasoline futures rose 5.7 percent in the report week. Net-long wagers on U.S. ultra low sulfur diesel increased more than fivefold to 10,835 contracts. Futures advanced 9.8 percent.

Rebounding after a two-year collapse, it’s only this month that oil prices have pushed up past $50 a barrel, but Raymond James & Associates says this is just the beginning for higher prices.

In a note to clients, analysts led by J. Marshall Adkins say West Texas Intermediate will average $80 per barrel by the end of next year — that’s higher than all but one of the 31 analysts surveyed by Bloomberg.

“Over the past few months, we’ve gained even more confidence that tightening global oil supply/demand dynamics will support a much higher level of oil prices in 2017,” the team says. “We continue to believe that 2017 WTI oil prices will average about $30/barrel higher than current futures strip prices would indicate.”

The team went on to lay out three reasons for their bullish call, all of which are tied to global supply — the primary factor that precipitated crude’s massive decline.

Here’s how the rebalancing of the global oil market will be expedited from the supply side, according to the analysts:

First, the analysts see production outside the U.S. being curbed by more than they had previously anticipated, which constitutes 400,000 fewer barrels of oil per day being produced in 2017 relative to their January estimate. In particular, they cite organic declines in China, Columbia, Angola, and Mexico as prompting this downward revision.

“When oil drilling activity collapses, oil supply goes down too!,” writes Raymond James. “Amazing, huh?”

Adkins and his fellow analysts also note that the unusually large slew of unplanned supply outages will, in some cases, persist throughout 2017, taking a further 300,000 barrels per day out of global supply.

Finally, U.S. shale producers won’t be able to get their DUCs in a row to respond to higher prices by ramping up output, the team reasons, citing bottlenecks that include a limited available pool of labor and equipment.

Combine this supply curtailment with firmer than expected global demand tied to gasoline consumption, and Adkins has a recipe for $80 crude in relatively short order.

“These newer oil supply/demand estimates are meaningfully more bullish than at the beginning of the year,” he writes. “Our previous price forecast was considerably more bullish than current Street consensus, and our new forecast is even more so.”

The only analyst with a higher price forecast for 2017, among those surveyed by Bloomberg, is Incrementum AG Partner Ronald Stoeferle. He sees West Texas Intermediate at $82 per barrel next year. The consensus estimate is for this grade of crude to average $54 per barrel in 2017.

Over the long haul, however, Raymond James’ team sees WTI prices moderating to about $70 per barrel.

Scroll to top