“We know perfectly how Mexico works, not only from a risk point of view, but also in terms of how the Mexican government and the regulators are setting the pace of this reform” Graciela Álvarez, Chief Executive Officer of NRGI Broker

Interview for Mexico Oil & Gas Review

Grupo Vitesse with their specialized new division NRGI Broker (Energy Insurance Broker) is a boutique firm targeting clients who want a personal advisor, either because they are new to the industry or because they want to pay close attention to the details in their business. The most important thing for NRGI Broker’s clients is that the firm has been at the forefront of the oil and gas sector for 25 years and is well acquainted with PEMEX. Having been active for a third of Mexico’s contemporary petroleum history, the firm witnessed the booming of the Sound of Campeche, where the largest field in the country, Cantarell, is located. “I was there at that time securing the EPC1, EPC2, and EPC3 contracts that gave rise to the Cantarell project,” shares Graciela Álvarez, Chief Executive Officer of NRGI Broker. She says a new period has now begun for NRGI Broker, as the firm seeks to consolidate itself in the shallow waters niche while keeping an eye out for any deepwater opportunities that might arise.

However, the capacity required to cover risks in deepwater operations is higher given the kind of incidents that could occur. Risks are lower for shallow waters, as operations are less complex. Certain international insurers are highly specialized in deepwater, a segment that is new to Mexico, where they will be able to make their niche. In addition, international insurers will find their mark in Mexico, according to Álvarez. This is because they have already tamed the challenging climactic conditions of the North Sea and overcome the socio-political risks of the Persian Gulf.

Another issue is that insurance companies are concerned about the accumulation of risks that will result from the number of platforms that are estimated to come into the same basin and the probability of hurricanes or wind storms. Despite these issues, NRGI Broker believes it will find working in Mexican deepwaters to be a familiar setting. “In Mexico, everything that has to do with the sea or subsoil is placed in foreign markets as a way to diversify risks, which is what we do through reinsurance. That is a normal and standard practice worldwide,” Álvarez comments.

For NRGI Broker, the opening of the sector comes at a great time as the company has spent years attaining knowledge and creating trust from its local customers. Their client list is made up of PEMEX contractors as well as oil and gas industries around the world through reinsurers. Alvarez states, “Our position has enabled the group to become a benchmark. We know perfectly how Mexico operates; not only from a risk point of view, but also in terms of how the Mexican government and the regulators are setting the overall pace of this Energy Reform.”

Álvarez is aware of the expectations surrounding the Energy Reform, and of the investment possibilities this brings about to oil companies, particularly those involved in deepwaters. However, the devaluation of the Mexican peso, the drop in the price of oil per barrel in the global market, and PEMEX’s budget cuts are affecting the entire industry. In fact, many of NRGI Broker’s long-term clients are now experiencing liquidity problems. “They had great expectations, so they hired senior professionals and made large investments to be ready to continue working competitively,” tells Álvarez. “The price drop and cuts to PEMEX’s budget cannot go unnoticed and the situation affects us all tremendously.”

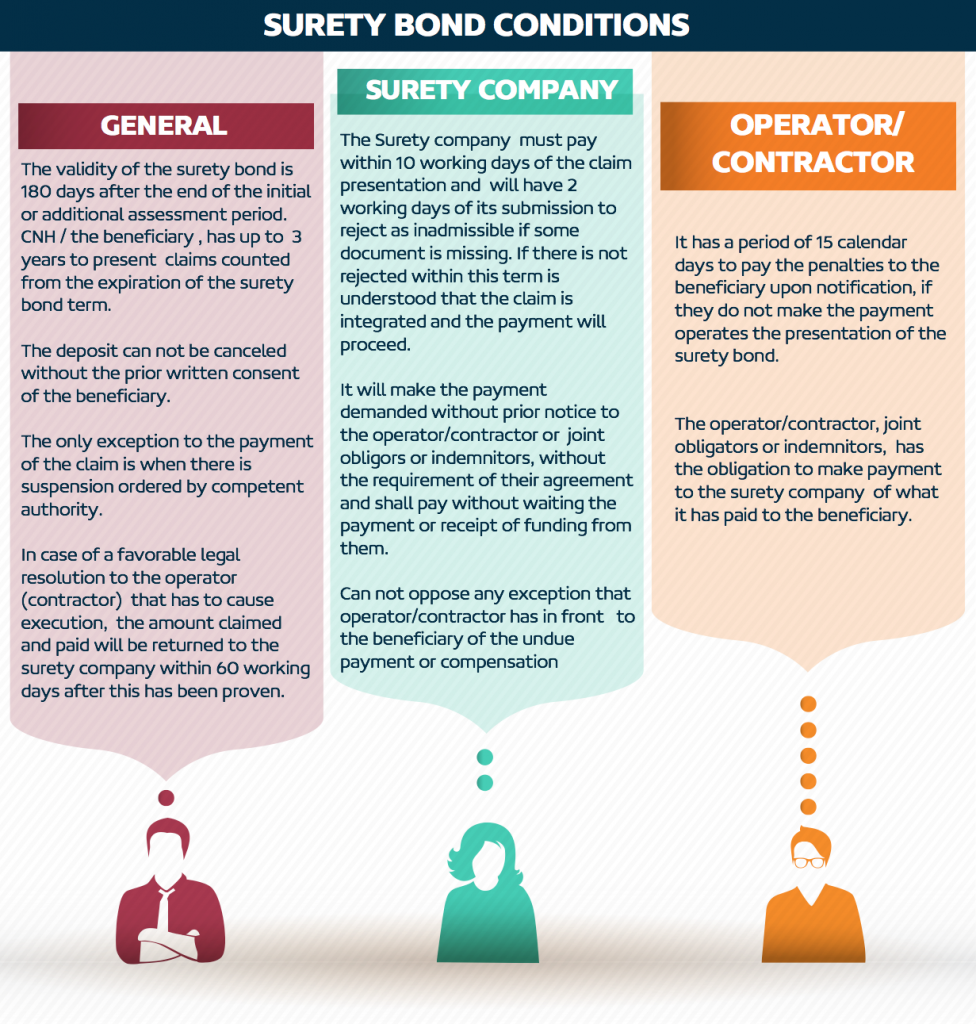

The oil industry is globally regulated and based on international safety standards. Insurance and security go hand in hand and, according to Álvarez, the entry of new players will spark positive changes. In terms of maintenance, I assume PEMEX will do what it has to do internally, and will be open to participating with foreign players in shallow water operations.” Nevertheless, she points out that the global industry is not well aware of PEMEX’s internal mechanisms. “It has traditionally been a paternalistic company that did provide some coverage to its contractors, but nowhere near enough to satisfy an insurer,” she adds. However, the Energy Reform will force players, including PEMEX, to make proper risk management plans. If not, the NOC and IOCs would risk being in serious trouble if an accident occurred without the proper coverage being in place.